Canada is considered around the world to be a so-called “rich” country.

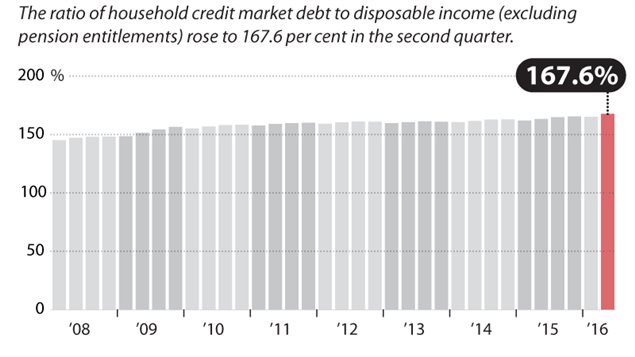

But it seems Canadians themselves are struggling more and more, as costs rise all around them but not salaries.

A new poll by Ipsos shows that almost a third of working Canadians are not earning enough to pay their bills.

The survey shows that this number , 31 percent, has increased about five percent just since the beginning of the year.

This apparent inability to pay off bills and debts makes them technically insolvent.

RCI- Sept: Canadians close to the financial precipice

The poll also noted that concern about their financial situation has risen as well. In February, some 43 percent were strongly or somewhat concerned about their debts, and this recent poll showed that figure to have increased substantially to 52 percent.

Concern about their own possible bankruptcy is also increasing. There has been talk about what would happen if interest rates, currently at historic lows, were to increase. In February, three in ten were concerned about the possibility of moving towards bankruptcy, but now four in ten have that concern.

This survey in September comes on the heels of a change in federal policy concerning mortgages.

Starting on October 17, new home buyers will have to pass a “stress test”. This is a new measure whereby the buyer must show they can still afford mortgage payments if the interest rates were to rise to the bank of Canada five-year fixed rate, which is often higher.

Also part of this new “stress test” requirement is that a home buyer will not be spending more than 39 % of income on combined costs of mortgage, heat and or electricity, and taxes.

As to why the people in financial difficulty don’t seek professional advice, the findings of the Ipsos poll show:

- One in four (25%) say they can’t afford to pay someone to help them;

- One in ten (13%) are embarrassed about their financial situation; and

- One in ten (10%) say they are embarrassed to ask for help

- 10% just don’t trust financial services to act in their best interest;

- 9% don’t think anybody can help them;

- 8% don’t know where to turn for help;

- 8% haven’t gotten around to it yet;

- 4% say bankruptcy is inevitable to them;

- 19% have some other reason for not reaching out to a professional.

additional information-sources

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.