Finland’s pulp industry shows record results

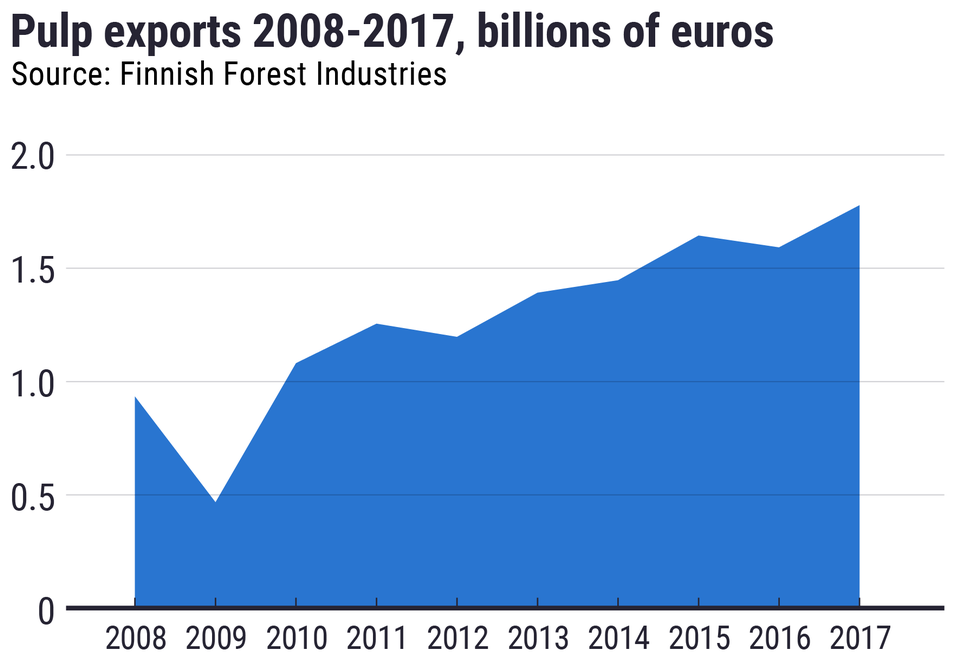

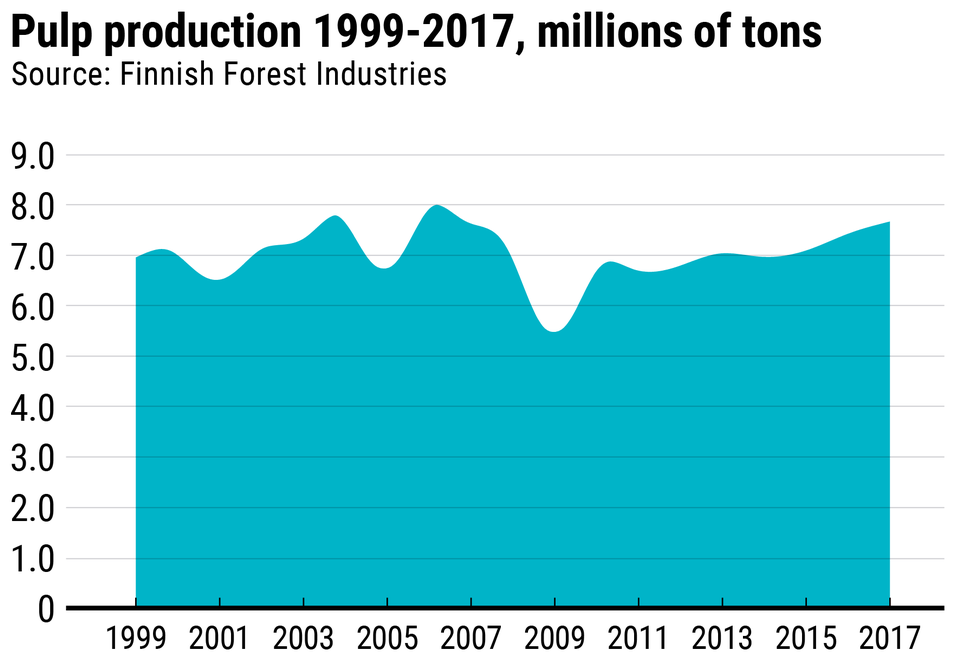

The pulp industry has been thriving for the past decade. Prices, production volumes and exports have all shown a steady rise.

The contrast with the previous decade is striking. Between 1999 and 2008 the pulp market seesawed up and down. During that period, production in Finland showed three clear rises and falls.

The deepest plunge was 2009 when a global recession dragged the sector down. Preliminary figures and growth estimates indicate that last year’s output matched the record level of 8 million tons set in 2006.

In 2017 Finland produced 7.7 million tons of pulp.

Transitioning away from paper

The back story on this decade of steady growth is that less pulp is going to the paper industry, a sector that is traditionally sensitive to economic fluctuations.

“Nowadays, pulp is increasingly used in consumer packaging, industrial packaging and also in new products in the bio-based economy, none of which are so susceptible to big variations in the economy,” says Stora Enso CFO Seppo Parvi.

Stora Enso has made a strong move away from paper.

“In 2006, 70 percent of Stora Enso’s volume of business was still [coming] from paper operations. Now that figure is only 30 percent,” Parvi points out.

Most recently, last Friday, Stora Enso announced that it will be shutting down yet another paper machine, this one in Imatra.

Megatrends support demand

Nowadays, pulp is also increasingly being used to produce tissue, cardboard and packing materials. Demand for these products is being boosted by global megatrends.

“These kinds of megatrends are, for example, population growth and the rise of the middle class in Asia, as well as expanding online sales which increase demand for packaging,” explains Maarit Lindström, chief economist at Finnish Forest Industries.

Replacing plastic packaging with fibre-based materials is also a growth factor for pulp. According to Finnish Forest Industries, the Pöyry consulting firm estimates that the market for pulp-based textiles and hygiene products, as well as fibre-based packaging will be worth 96 billion euros by 2030.

Increasingly stable

Maarit Lindström stresses that there will continue to be fluctuations in the pulp production sector. However, the ups and downs will be less acute than when pulp was still primarily a raw material for the paper industry.

It may take time, though, before investors are convinced that the pulp sector has moved into a new, more stable business environment.

Antti Viljakainen, an analysis for the Helsinki investment consultancy Inderes says that this new business model for forest industry companies will have to ride out a clear recession before it is possible to say if they are better buffered against economic fluctuations.

Today, investors continue to view them as being vulnerable to developments in international markets.

“When you look how much share prices have come down from the summer’s peak, you see that investors still consider the forest industry as a cyclical sector,” Antti Viljakainen adds.

Related stories from around the North:

Canada: Employment rate drops in 2018 in Nunavut, east-Arctic Canada, CBC News

Finland: Struggling to hire, Finnish firms send mixed economic signals, Yle News

Sweden: Sweden to support forest industry following historic summer wildfires, Radio Sweden