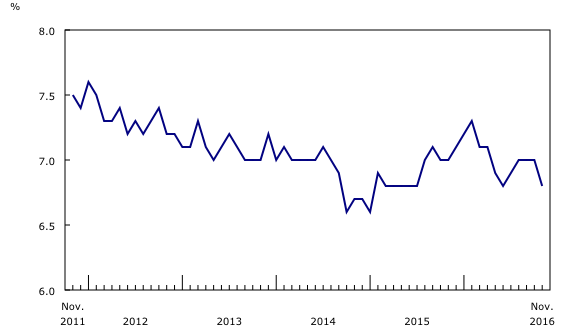

The Canadian economy added 10,700 new jobs last month driving the unemployment rate to 6.8 per cent, but the latest numbers raise questions about the quality of these new jobs.

November saw another decline in full-time work positions, while the economy churned out thousands of new part-time jobs, Statistics Canada’s November employment survey shows.

The report says the market added 19,400 part-time jobs last month and shed 8,700 full-time positions.

“We’ve got lots of people working in Canada but increasingly they are being staffed into part-time jobs,” said Avery Shenfeld, chief economist at CIBC. “And that really is a continuation of a trend we’ve seen over the past year with very strong growth in part-time employment but a net decline in full-time jobs.”

(click to listen to the full interview with Avery Shenfeld)

ListenCompared with November 2015, Canada gained 183,200 jobs overall. But over the past year, Canada has lost 30,500 full-time jobs, while gaining 213,700 part-time jobs.

Soft manufacturing sector

The country’s goods-producing sector lost 20,600 positions with construction and manufacturing seeing the biggest declines. The cheaper Canadian dollar has yet to lead to a rebound in Canada’s manufacturing sector.

“There are two problems, one is that manufacturing employment is dropping in other countries that are seeing manufacturing output growth because increasingly factories are automated,” Shenfeld said. “And then the second problem for Canada is so many manufacturers closed during the period when the Canadian dollar was strong that the existing manufacturers are actually running pretty full tilt.”

Canada would need new entrants in its manufacturing sector, companies putting up new factories or expansions to see a rebound in its manufacturing jobs, Shenfeld said.

“If you actually look at the economy as whole, the economy looks like a doughnut with a big hole in the middle,” Shenfeld told RCI. “And the hole in the middle is the energy sector and the energy producing provinces where employment is dropping off sharply.”

Statistics Canada

‘Stark differences across the provinces’

Oil-rich Alberta lost 13,000 jobs in November. At the same time, the number of job-seekers increased by 11,000 people, pushing the unemployment rate up 0.5 percentage points to 9 per cent—the highest rate since July 1994, Statistics Canada reported. Compared with November 2015, unemployment in Alberta increased by 30.6 per cent.

“In other provinces – Ontario, Quebec, British Columbia – employment growth actually still looks fairly healthy,” he said. “So the national picture still looks fairly soft but it masks quite stark differences across the provinces.”

Ontario gained the most jobs last month with 18,900 new positions, an increase of 0.3 per cent compared with October.

British Columbia lost 600 positions last month, but compared to a year earlier it still led all provinces with the fastest growth rate of 2.1 per cent.

Quebec added 8,500 jobs in November and, compared to 12 months earlier, employment there climbed by two per cent.

Nova Scotia saw a month-over-month increase of 0.8 per cent in November by adding 3,700 jobs. The increase, however, was fuelled by part-time work as the province lost 200 full-time positions.

‘Watchful waiting’ on interest rates

“We still have an economy that is blowing hot and cold at the same time,” Shenfeld said. “The labour market is quite strong in parts of Canada that aren’t suffering the direct blow from the energy sector but we still have an ongoing recession in Alberta, very weak employment in Newfoundland and Saskatchewan, anything touched by declines in oil activity is still very soft.”

Shenfeld said he expects the Bank of Canada to adopt a “watchful waiting” attitude on interest rates.

“The US Federal Reserve is on the verge of raising interest rates and they are likely to do that over the next two years,” Shenfeld said. “The Bank of Canada may well sit with very low interest rates for a while longer because we’ve got room for some healthy job growth before we would be worried an inflation problem in Canada.”

With files from The Canadian Press

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.