Q&A: Commissioner Sullivan notes new Asian interest after Alaska LNG sales trip

Alaska’s effort to develop the largest natural gas field in North America is basking in a burst of sudden attention from potential Asian buyers and investors, says a key state official.

Alaska’s effort to develop the largest natural gas field in North America is basking in a burst of sudden attention from potential Asian buyers and investors, says a key state official.

The interest follows the Parnell administration’s decision to tout the benefits a large-scale liquefied natural gas project in Alaska could mean to governments and utilities in Asia.

Alaska Governor Sean Parnell and Natural Resources Commissioner Dan Sullivan traveled separately to the continent in September to demonstrate to officials how the North Slope gas field can help meet growing demand in countries such as South Korea or Japan.

Entities such as Korean Gas Corp. (KOGAS), the world’s largest buyer of liquefied natural gas, are continuing the dance with the state. They have requested follow-up meetings and more data, and in some cases accepted the administration’s invitation to visit Alaska to learn more.

In a recent interview, Sullivan said the interest is a sign of progress. Alaskans have long hoped the North Slope gas would sustain the state’s economy as Prudhoe Bay oil production dwindles.

Sullivan believes it also shows that Alaska’s liquefied natural gas project stands out among an aggressive field of competitors that includes projects in Canada, Australia, Russia, Mozambique and the Lower 48. Helping raise the project’s profile are stories that have run in major news sites, such as the Wall Street Journal, that the oil majors in Alaska are coming together in an effort to market North Slope gas.

You might think the three major oil companies that control rights to most of the North Slope gas and are studying a gas line for LNG shipments — ExxonMobil, ConocoPhillips and BP — would be eager to market their treasure. But the companies say before that happens they must finalize basic details, such as the size of a pipeline and a final route, according to Sullivan.

The administration takes a different view, believing the marketing must happen now because Alaska has a limited window of opportunity to get its foot in the door among Asian buyers.

One hope is that interest abroad will spur the oil companies to build a line more quickly, Sullivan acknowledged. Perhaps those Asian companies will even agree to invest up front, as KOGAS has done around the world. One company, Resources Energy Inc., has suggesting it would build the liquefaction plant.

In his conversation with the Dispatch, Sullivan walked through a presentation he’s given the Asian entities. That includes touting the “comparative advantages” of Alaska LNG — its huge abundance, relatively easy access, and affordable costs.

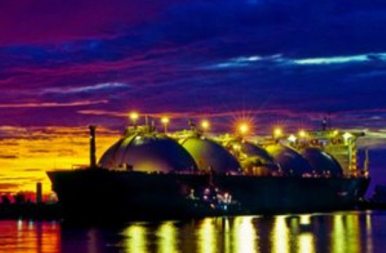

As commonly envisioned, the fabled gas line project would likely extend some 800 miles to Valdez or some other port. There, the gas would be liquefied at a plant and loaded onto ocean-going ships.

Then again, who knows? Like other Alaska gas line projects, an Alaska-to-Asia LNG proposal has been tried before, and failed. That effort, led by Yukon Pacific Corp. in the 1980s and 1990s, died after the promising Asian market tanked, oil companies lost interest, and the Knowles Administration got behind a highway project to Canada.

Here’s a portion of Alaska Dispatch’s conversation with Sullivan.

——————————————————————————–

——————————————————————————–

Dan Sullivan: One thing we’ve said to potential companies, and we’ve met with gobs of them, “Hey if you’re interested and you want a full briefing from our Department of Natural Resources, (and) to meet with the (oil) producers potentially, come on over (to Alaska).”

In the last five-to-six weeks, we’ve had KOGAS here, that’s the big one. They’re the largest importer and buyer of natural gas LNG in the world. It wasn’t mid-level bureaucrats, it was the CEO and president and his LNG purchasing-and-strategy team.

We had Mitsui, which is one of the big powerhouse Japanese trading companies. They do LNG projects all over the world. They came separately (from KOGAS). We hosted them two days here. It was mostly at DNR, with briefings, meeting all kinds of folks. It was (their) middle-level team, not the CEO-type team. But still, these are all companies, after our briefing in their country, that were reaching out to us.

Resources Energy — a company that opened an office here — their leadership team was just here. Mitsubishi Heavy Industries, which is another big powerhouse, didn’t come for a visit, but certainly as a result of our meetings in the fall they called us. We had a two, three-hour conference call with them on a whole host of things that they’re interested in. This is (all) literally in the last six weeks.

One of the most promising (developments) was this most recent KOGAS meeting on Dec. 10.

Mr. Choo (president and CEO of KOGAS) came here for two days, after a presidential election (in South Korea) just happened. He’s one of the most serious government officials there and works for a company owned in large part by the government, and they brought their whole team here. We had them meet with a few producers, which was part of that strategy to help spur action. I think those meetings went well, though I didn’t sit in on them. I can tell you there is a very serious focus from their perspective on North America for gas and a strong, strong desire to diversify their supplies away from the Middle East, away from Australia, and away from Russia.

I spent most of my time (discussing) the comparative advantages over other possible sources of LNG supply they are considering. This is a very powerful element of what we bring to the table.

One our best selling points: We have a gargantuan, super well-known resource base. They love that, love it. This is also very important: the project would be co-located next to existing infrastructure, which means a small surface footprint. And we’re working on an expedited regulatory timeline, because so many of these things have already been approved, rights of ways, EISs, pipelines.

The Japanese in part think this is fantastic: Our record of reliability, the best record in the world, right? Forty-two years, never missed one cargo shipment. Trust me, in Tokyo, I really highlighted this. And right here, this is obviously a jab at the Russians: Alaska does not use gas for political purposes.

When I was Assistant Secretary of State (under George W. Bush), I was kind of the lead guy on Central Asia energy issues and Caspian Sea energy, which is big geostrategic stuff for the U.S. The Russians are all over that place. They cut off gas to the Ukranians. They muscle people. They are not necessarily who you want at the production supply part of your pipeline if that pipeline is absolutely critical to your economy and you don’t want to be blackmailed.

These next slides talk about Alaska’s proximity, which of course brings huge advantages, legal stability, cost competitiveness. Two studies in the last year showed us coming in very strong from a cost-competitive standpoint, particularly this Brookings Institute study. The big Alaska project, 3.1 billion cubic feet a day, comes in, according to Brookings, as the lowest cost (over other projects globally). We didn’t have anything to do with that report. When I heard the report was in the works I called them, I said, ‘I heard you’re doing a big cost-benefit. I said are you going to mention Alaska? They said ‘No, we’re highlighting Alaska.’

Alaska Dispatch: Why is our gas cheaper than Australia?

Sullivan: One of the things you’ll see is happening in Australia is you have huge cost overruns hitting their projects.

Other competitive advantages are Alaska’s world-class business environment, very strong oil and gas service support. A lot of people don’t know that under the law, the president has to authorize exports. President Reagan already did that. We happen to think that presidential finding is still valid. We’ve shown that to the White House, shown it to the Department of Energy. But even if they don’t think it is — our lawyers think it is — this is still a really good precedent.

And then as I mentioned earlier, these (Asian entities) love upstream, downstream investment opportunities, and I always pitch, ‘Hey you want an upstream opportunity, this is the ultimate upstream opportunity. Participate in our lease sales.’

Alaska Dispatch: How does the North Slope compare to other LNG projects?

Sullivan: We’re like, ‘OK, we know you’re looking at potential other competition. Let’s talk about the other competition.’ Western Canada, British Columbia, is probably our biggest competition in our view. They’re a resource risk, as we call it. Those are all shale plays, they’re not conventional. Our gas is jumping out of the ground. We’re reinjecting 8 billion cubic feet a day. To develop their gas, they’re going to have hundreds if not thousands of wells and fracking. We don’t have that problem here.

And they have the huge issue of they have to build a big pipeline for any of those projects. And they have serious First Nations Native claims issues they have not resolved. Those can take a long time, and those have to be solved by the federal government. And obviously we don’t have those issues. We’ve solved them. So I showed them a couple articles that talked about the problems of that.

Lower 48 shale, I said, ‘Look it’s still controversial. With regard to shale, if you look at just the Gulf there, the export infrastructure is going to constrain those projects.’ You won’t be able to get the volume you have in Alaska. And there’s certainly going to be some element of regulatory limits, maybe less with the Koreans, because they’re a free-trade partner.

But one thing, when you get an export license, there’s always a provision that says if there’s demand that needs to be met domestically, sorry, your exports will take second fiddle. In the Lower 48 that’s a big risk, because this gas is feeding everybody (in) an economy that’s 25 percent of the global economy. In Alaska that’s a very small risk if we get the big line, 3.1 bcf a day. Even if we get Agrium and other end users, our domestic demand will never overwhelm the supply, never. It won’t be a risk.

Australia, I hit on the serious cost overruns, this Gorgon project, which is huge, started out as an estimated 38 billion dollar project. It’s now up to 50 billion. The Wall Street Journal had a big article on truck drivers making $250,000 a year because labor costs are skyrocketing. The problem they have is they have so many LNG projects going. Australia in the next 10 years is set to overtake Qatar as the largest LNG exporter in the world. So the place is hot, hot as can be, and that’s what’s driving up labor costs, inflation costs.

And Russia, again, a resource risk. That’s an Arctic play, and (there are questions of) reliability and political stability. Mr. Putin, if he gets mad at your prime minister or country, next thing you know, you got no gas. Everybody knows that. No one wants to rely on these guys. They have a very bad record for reliability, unlike ours. Qatar on the other hand, has strong record of reliability, but they’re in the most dangerous neighborhood in the world.

Alaska Dispatch: So the state’s doing all this marketing, but what are the oil companies doing?

Sullivan: They claim you have to be very careful, and we would too. You have to be careful on antitrust laws. We haven’t run that to ground yet, but we are encouraging them, as you can imagine, to work the marketing angle as well.

Alaska Dispatch: What size, what route?

Sullivan: Exactly, and trust me on that one, we’ve been pressing them quite a lot to get to that point. So if you look at their public timeline, these are the different stages they go through. Any big project in the world goes through this. You come up with the concept, you go into front-end engineering, then you go into the sanction decision. That’s the key (decision), and each time they move through what they call stage-gates, they spend a lot more money and put more people on it. Now they have about 200 people on it, and they spend tens of millions. But we’re trying to get them rapidly into this pre-feed stage. I think they’re relatively close, but that’s when they move into the half-a-billion-dollar spending range, and instead of 200 people, about 500 people are working on it. So we’ve been pressing that to happen. Their argument back is we need the full concepts, the volumes, the routes, before we can do that (marketing), but we’re hoping soon. In the past, my understanding is the state’s been passive: ‘OK you guys (major producers) are in charge, it’s your gas.’ And we’re like, ‘Wrong answer, we’re moving this, we’re doing it.’ Go ask them (the oil companies). Maybe they like it, maybe they hate it. We don’t necessarily care. We think it’s in our interest to do this now.

Contact Alex DeMarban at alex(at)alaskadispatch.com

For more stories from Alaska Dispatch, click here