Canada’s northern territories among world’s most attractive mining regions for investors, survey says

Canada’s northern territories are among the most attractive jurisdictions in the world to mining companies, according to the latest annual ranking from the Fraser Institute.

All three of Canada’s territories improved in the rankings compared to the previous year.

The conservative-leaning think tank surveys industry professionals every year to gauge perceptions of different mining jurisdictions. The survey focuses on mineral potential, as well as public policy and regulations.

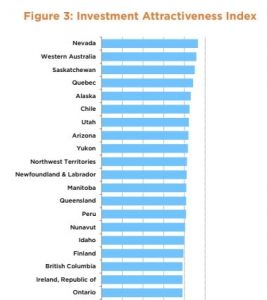

Yukon (northwestern Canada) ranked ninth in “overall attractiveness” in 2018, up from 13th in 2017. The Northwest Territories (central Arctic) jumped even more — from 21st in 2017, to 10th in 2018.

In Canada, only Saskatchewan (Prairies) and Quebec (East) ranked higher — third and fourth, respectively.

Nevada topped the list and Venezuela bottomed out at 83rd in the rankings.

Nunavut (eastern Arctic), meanwhile, rose from 26th in 2017 to 15th in 2018.

The rankings are based on responses to an electronic survey sent to mining, exploration and consulting companies. Approximately 2,600 surveys were sent out and 291 were returned — enough to give an accurate picture, said Ashley Stedman, one of the co-authors of the study.

“We are confident that our results are reflective of how investors feel about particular jurisdictions, and the policies and regulatory environments in those jurisdictions,” she said.

Transparency an issue

According to the survey, the territories look good when it comes to mineral potential but investors are not as excited about mining policy and regulation in the North.

“The results do show that policy reforms are still needed for these jurisdictions to capitalize on their mineral potential,” Stedman said. “Mineral deposits alone are not enough to attract investment dollars.”

The survey found that transparency in the exploration permitting process is a concern for investors in the N.W.T. and Nunavut. For the N.W.T., half the respondents said it was a deterrent to investment, and for Nunavut, 87 per cent said it was. For Yukon that number was about 29 per cent.

Nunavut and the N.W.T. also fared poorly when it came to investors’ confidence that they would eventually be granted necessary permits for exploration. For Nunavut, more than half reported “low” confidence or no confidence at all. In the N.W.T., 40 per cent reported low or no confidence.

Yukon did much better on that score — only 9.5 per cent of respondents reported low confidence that they’d get their permits. The rest reported either confidence or “high confidence.”

Lack of infrastructure is also deterring investment in Nunavut and the N.W.T., Stedman said, along with “regulatory duplication and inconsistencies.”

She also cited “disputed land claims” as a deterrent to investment in the N.W.T. and Yukon.

The Fraser Institute uses the annual report as a way to encourage “streamlining” of mining regulations in Canada.

“We like to see this survey in particular as a report card on government policies, that governments can use to ultimately improve their policy and regulatory environment,” Stedman said.

Related stories from around the North:

Canada: Northern Canadian territory tables mining act requiring benefit agreements with Indigenous govs, CBC News

Finland: Stricter mining regulations and oversight needed in the Arctic, Finnish report says, Yle News

Norway: Mining waste dump project in Norwegian fjord worries Russia, The Independent Barents Observer

Russia: Russian miners dig deeper into vast Kola nickel reserve, The Independent Barents Observer

Sweden: Iron mine in northern Sweden to restart production, The Independent Barents Observer

United States: Mining company boosts spending to lobby U.S. government for contested Alaska project, Alaska Public Media