Proposed sale of N.W.T.’s Ekati diamond mine touted as ‘good for the North’

As the Northwest Territories’ oldest diamond mine approaches its closure, an Australian company is eager to buy it and hopefully extend its life.

On Monday, Burgundy Diamond Mines announced its intention to acquire all the shares of Arctic Canadian Diamond Company Limited, including its primary asset, the N.W.T.’s Ekati diamond mine, for $187 million ($136 million US). Pending financing and the approval of Burgandy’s shareholders, Arctic Canadian expects the deal to close in late April.

“The real advantage is it’s a tier-one asset in a tier-one country, which is really important for us,” said Burgundy’s CEO Kim Trutter, about Ekati. Trutter is also listed as a director on Arctic Canadian’s board.

Trutter sees untapped potential in Ekati, and says he’s “very confident” Burgundy will be able to extend the mine’s life “significantly.”

‘Canadian diamonds are highly sought after’

Canadian diamonds are an attractive commodity right now.

Industry observers say diamond prices have reached new heights over the last few years, and with the war in Ukraine, buyers are turning their backs on Russia, one of the world’s top diamond producers.

“Source of origin of diamonds is becoming very, very important,” said Rory Moore, president and CEO of Arctic Canadian Diamond Company. “Canadian diamonds are highly sought after because they come with a guarantee of ethical mining practices, both in terms of treatment of people as well as the environment.”

Ekati is attractive for other reasons, too — the fancy yellow stones it produces.

Those coloured diamonds are a focus of Burgundy’s cutting and polishing operation.

Burgundy wants to own every part of its supply chain, from mining through to polishing and retail, and Trutter said Ekati is key to achieving that goal.

Burgundy would look at ‘innovative options’ to extend mine’s life

The announcement of the proposed sale comes a little more than two years after Calgary-based Arctic Canadian bought Ekati from Dominion Diamond Mines, which had filed for insolvency protection.

On Tuesday, Burgundy, a public company listed on Australia’s ASX stock exchange, released more details about the planned acquisition.

The company, which has seen three consecutive years of declining profits, would raise $206 million ($150 million US) and pay down a majority of Arctic Canadian’s debt of about $136 million ($100 million US).

Burgundy also says it would look at “innovative options” to extend the mine’s life, including underwater remote mining, exploration using AI technology, and the possibility of developing the Jay deposit and the Fox Underground pit.

‘We want the mines to continue’

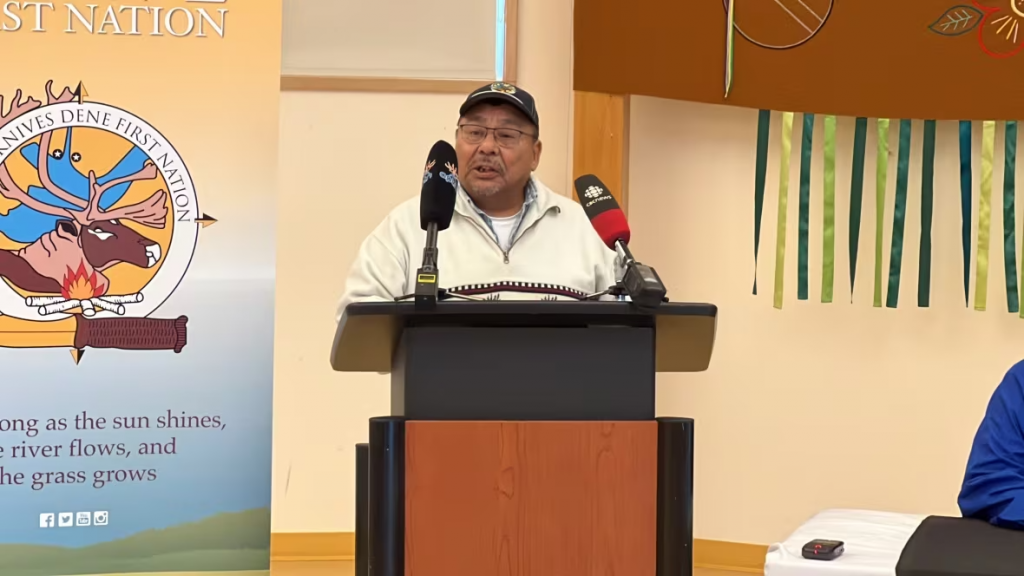

That would be good news for Yellowknives Dene First Nation.

Chief Fred Sangris of Ndilǫ said a lot of Indigenous people in the North work at N.W.T. mines, including close to 200 Yellowknives Dene members.

“We’re always concerned about work. If the mine closes, then it’s not good for many of the workers working in the mines,” he said.

“We want the mines to continue.”

Tom Hoefer, executive director of the NWT and Nunavut Chamber of Mines, said the proposed sale is good for the North.

“Ekati is a big mine, it’s over 1,000 workers, and it contributes a lot to our economy,” he said. “To see it operate longer is good for the whole North.”

Beyond Ekati’s workers and contractors, said Hoefer, extending the mine’s life benefits the territory as a whole through taxes, royalties and impact benefit agreement payments.

The Yellowknives Dene First Nation is among four Indigenous groups that have impact benefit agreements with Ekati. Sangris said the sale wouldn’t affect their agreement.

In an emailed statement N.W.T.’s Industry, Tourism and Investment Minister, Caroline Wawzonek, said Ekati plays an important role in N.W.T.’s diamond industry.

The proposed sale, she said, would increase the equity available for more exploration and new projects at the mine, “which will hopefully extend mine life.”

Related stories from around the North:

Canada: Yukon gov’t boasts of ‘strongest economy in Canada,’ tables $48M surplus budget, CBC News

Norway: Norway’s oil minister: “We need new discoveries”, The Independent Barents Observer

Russia: Crisis-ridden Russian gas industry looks to Arctic for more LNG, The Independent Barents Observer

United States: Alaska politicians applaud, environmental groups denounce, Arctic project go-ahead, Eye on the Arctic