Blog: Alaska ships its first oil to Asia in a decade

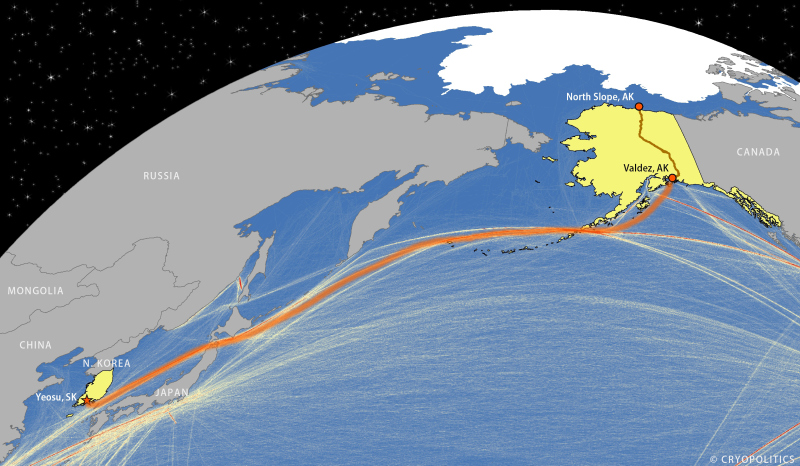

On September 26, ConocoPhillips‘ Polar Discovery departed the Valdez Marine Terminal in Alaska for Yeosu, South Korea.

Valdez is where the Trans-Alaska Pipeline, which runs from the North Slope, terminates. The North Slope produces the bulk of Alaska’s oil. Polar Discovery can carry 784,000 barrels – about a day and a half’s worth of North Slope production. The tanker belonging to ConocoPhillips, Alaska’s biggest oil producer, is transporting the first shipment of oil from Alaska to Asia in ten years.

The 1975 Energy Policy and Conservation Act, passed during the oil embargo to protect American consumers from price shocks and volatility, generally prohibits U.S. oil from export. Debate over the practicality of the law has grown in recent years, especially thanks to the hydraulic fracking boom in North Dakota. Still, only a few select locations in the U.S. are exempt from the ban. Oil transported through the Trans-Alaska Pipeline has been permitted export since1996, while Cook Inlet oil has enjoyed the privilege for a longer time, since 1985. At the time, then senator Frank Murkowski (R-Alaska) declared,

“This is a small beginning but it can be a catalyst to unlock some of the previously impenetrable barriers.”

If that name sounds familiar, that’s because Murkowski is the father of current Senator Lisa Murkowski (R-Alaska), who filled his seat when he became governor in 2002. She then won election in 2004. Remarking on the export of North Slope oil to Korea, Murkowski stated in words that echoed her predecessor:

“This is the first North Slope cargo to leave Alaska for overseas markets in a decade. I am encouraged to see Alaska increasing its participation in global oil markets. It’s my hope that Lower 48 oil will soon follow suit.”

South Korea and Arctic oil

South Korea’s purchase of Alaskan oil fits into its quest to diversify its sources of oil. When Alaska exported oil previously from 1996-2004, South Korea purchased nearly half of the state’s 95.49 million barrels of crude oil exports. The rest all went to other Asian countries, yet the total exports only accounted for 2.7% of state production.

Currently, South Korea imports most of its oil from the Middle East, but that picture is changing. The below pie charts from the U.S. Energy Information Administration illustrate how Russia has entered the picture since 2011; the country now provides 4% of Korea’s imports. Whether South Korea will increase its reliance on Russia is unknown, since the crisis in Ukraine has called into question Russia’s reliability as a provider. In any case, a further rebalancing from 2013 is probably necessary due to a host of other geopolitical problems. Already, South Korea has cut oil imports from Iraq. Imports from the war-torn Middle Eastern country, which accounted for 10% of oil imports in 2013, fell by 23.4% from January to April of this year compared to the same period last year.

Pipelines to the Arctic

Thanks to the construction of new pipelines in the Russian Far East, the country is becoming an ever more important source of oil for countries in East Asia. The capacity of the East Siberia-Pacific Ocean Pipeline (ESPO), which opened in 2010 and stretches all the way from oil fields in West Siberia, will reach 600,000 barrels a day by 2015. For comparison’s sake, the Trans-Alaska Pipeline (TAP), which transported the oil from the North Slope to Valdez that is now making its way to Yeosu, has a capacity of 2.1 million barrels a day. In 2013, however, Oil and Gas Journal reported that less than 25% of that was being utilized. Production has continued to drop, going from 515,000 barrels a day in 2012 to 500,000 in 2013.

These low figures mean that producers want to get the most money possible for each barrel of the precious fossil fuel.The Los Angeles Times quoted ConocoPhillips as stating on the sale to South Korea, “We are entering into this transaction because during the trading period for this volume, bids from Asian customers were higher than bids from USWC customers.” Alaska may also be trying to undercut its giant neighbor to the east: Bloomberg reports that Alaska North Slope crude sold for $95.32 per barrel on September 29, 51 cents lower than Russia’s ESPO crude.

ESPO will likely continue to up the ante for TAP, though. This brilliant paper by Masumi Motomori (firewalled) on Japan’s need for Russian oil and gas, published in the peer-reviewed journal Energy Policy, suggests that ESPO will begin carrying oil from Gazprom’s Messoyakha project, located in the Arctic region of the Yamalo-Nenets Autonomous Okrug, in 2016. As will all oil and gas projects, and especially Russian ones, this prediction must be taken with a grain of salt, especially since there don’t seem to be many new updates regarding the project’s status. But if Messoyakha comes online and begins exporting oil through ESPO, the Hyundai and Daewoo cars on the streets of Seoul may be more likely to burn Russian Arctic oil than Alaskan Arctic oil unless ConocoPhilipps’ breakthrough sale becomes the rule rather than exception.

The Port of Yeosu

South Korea is therefore obtaining Arctic oil by both pipeline and tanker. The country’s Port of Yeosu fits into what arguably constitutes an expanded zone of Arctic destinational shipping. The Arctic Marine Shipping Assessment (PDF) defines destinational shipping as “conducted for community re-supply, marine tourism and moving natural resources out of the Arctic”.

Last year, one ship sailed from Ust-Luga, Russia, located on the Baltic Sea, with nearly 80,000 tons of naphtha via the Northern Sea Route to the Korean port. Located in Northeast Asia, Yeosu is strategically situated at the confluence point of the shipping lanes of the Northern Sea Route and the North Pacific Great Circle Route, which connects East Asia with the Pacific Northwest [2].

It’s also possible that Yeosu could one day obtain more than just oil from across the Pacific. In April, the U.S. Department of Energy granted ExxonMobil a two-year license to export LNG from the Kenai Peninsula. As with oil exports, Alaska will have to compete with up-and-coming nearby LNG providers, as numerous liquefaction terminals in British Columbia and Oregon are planned. All of these new sources combined with the expansion of Russia’s Sakhalin II LNG project mean that Asia could benefit from reduced oil and gas prices – but this will come at the expense of the Arctic and sub-Arctic environments.

Further Reading

[1] “How much oil is produced in Alaska and where does it go?” U.S. Energy Information Administration. [2] I discuss the importance of these two shipping routes in a paper published in Eurasian Geography and Economics(2014) called “North by Northeast: Toward an Asian-Arctic Region.” It is available for free download this month here.This post first appeared on Cryopolitics, an Arctic News and Analysis blog.

Related stories from around the North:

Asia: Full steam ahead for Asian icebreakers in the Arctic this summer, Blog by Mia Bennett

Canada: Canada’s Arctic patrol ships – A $250M mystery, CBC News

Finland: New Finland icebreaker can operate sideways with asymmetrical hull, Yle News

Russia: Russia, icebreakers and Arctic identity, Blog by Mia Bennett

Sweden: Swedish icebreakers gear up for Arctic role, Radio Sweden

United States: Hearing on U.S. Policy in the Arctic – ‘Let Russia do it for us…’?, Eye on the Arctic