China’s Arctic Road and Belt gambit

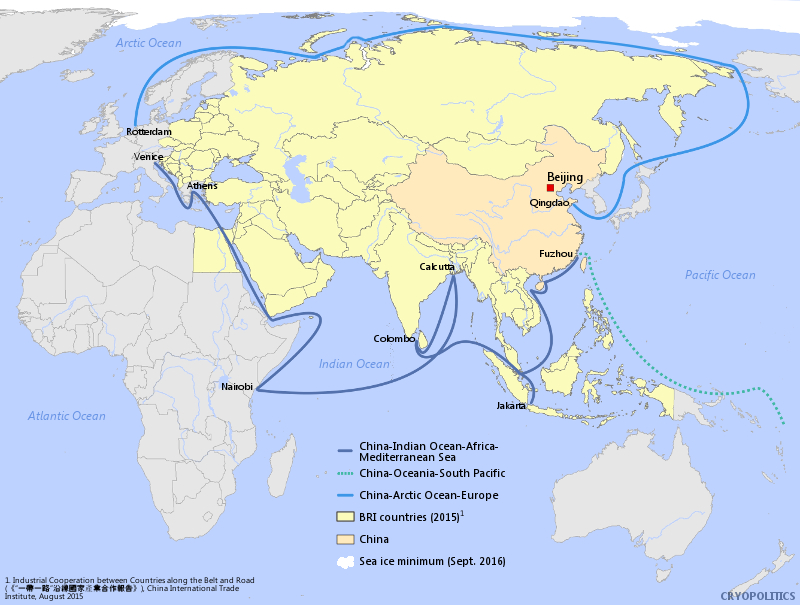

Strategic concerns over the vulnerability of China’s current trade routes and climate change are pushing Beijing to pay growing attention to developing new transport infrastructure and shipping routes across the increasingly accessible Arctic, experts say.

In recent weeks China has made several headlines that illustrate Beijing’s growing interest in developing economic links, gaining scientific knowledge and expertise of operating in the Arctic.

The Chinese-state owned shipping giant COSCO has expressed strong interest in developing an Arctic deep-water port on the Northern Dvina River near the northern Russian city of Archangelsk and building a new railway to transport natural resources from the Siberian heartland to China and other world markets via the Arctic port, The Barents Observer has reported.

The Chinese icebreaker Xuelong (Snow Dragon) is on its way home to Shanghai after completing its first circumnavigation of the Arctic where it travelled through both the Northern Sea Route along Russia’s Arctic coast and the Northwest Passage through the Canadian Arctic Archipelago in one shipping season.

21st century Silk Road

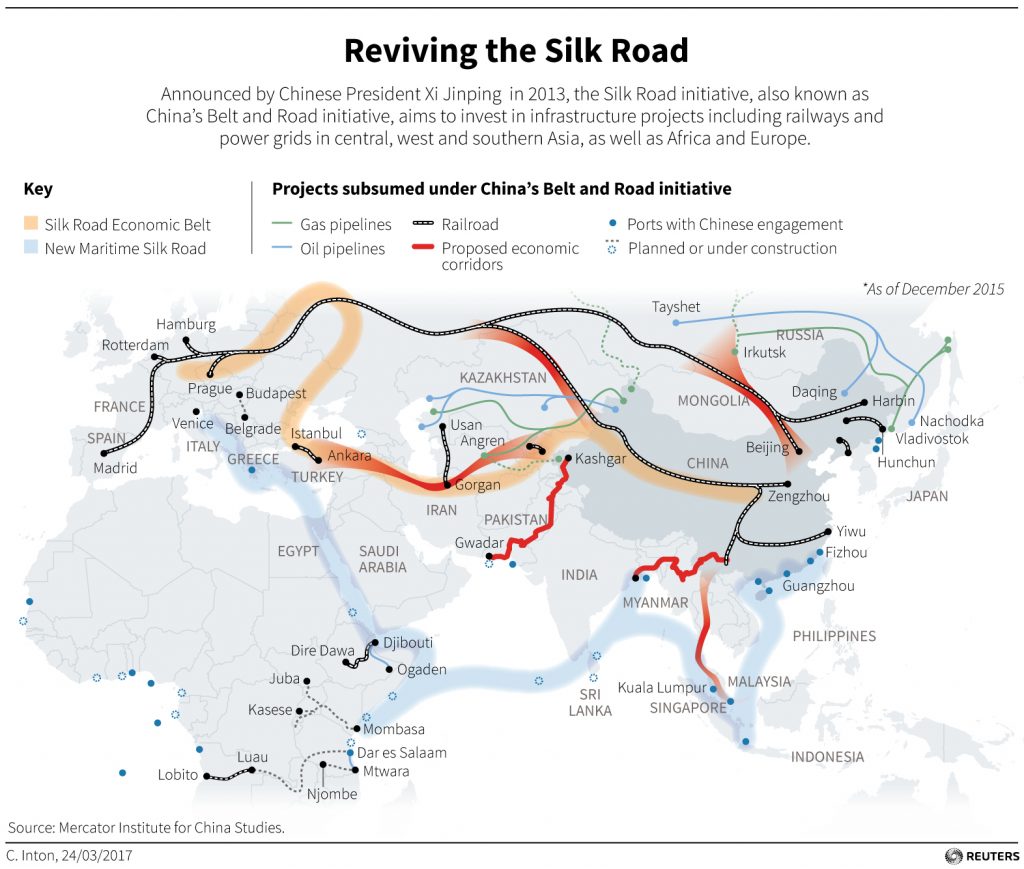

These seemingly unrelated events are a small part of a grandiose project called One Belt, One Road (OBOR), a $5 trillion plan to upgrade transport infrastructure between Asia and Europe being promoted by Beijing for the last four years, experts say.

Also referred to as the Silk Road Economic Belt and 21st-Century Maritime Silk Road, the strategy is the brainchild of Chinese President Xi Jinping, who has championed the project during his meetings with world leaders and at international fora, most recently at the Belt and Road Forum for International Cooperation held in Beijing in May.

The goal of the initiative, which would see China build a land-based and maritime transport web across the globe, “is to advance regional cooperation, strengthen communication between civilizations, safeguard world peace and stability, achieve common development, and pursue a better life,” said a statement by the Chinese embassy in Canada.

Peter Cai, Nonresident Fellow at Australia’s Lowy Institute, said that with its land-based Silk Road Economic Belt Beijing aims to connect the country’s underdeveloped hinterland to Europe through Central Asia.

“The second leg of Xi’s plan is to build a 21st Century Maritime Silk Road connecting the fast-growing Southeast Asian region to China’s southern provinces through ports and railways,” Cai wrote in an analysis paper in March.

Over sixty countries with a combined population of 4.4 billion and accounting for around 29 percent of global GDP participate in the initiative.

And now climate change and the rapid loss of sea ice in the Arctic is presenting Beijing with another alternative to “diversify its portfolio” of trade routes, said Frédéric Lasserre, professor of geography at the Université Laval in Québec City, Canada, and the director of the Quebec Council of Geopolitical Studies, whose research focuses on geopolitics of the Arctic region.

Strategic and geopolitical concerns

The OBOR strategy reflects Beijing’s preoccupation with its so-called “Malacca Dilemma,” Lasserre said in a phone interview with Radio Canada International.

The term refers the fact that a lion’s share of China’s trade goes through a few strategic chokepoints – chiefly the Malacca Strait between the Malay Peninsula and the Indonesian island of Sumatra and the Bab-el-Mandeb Strait between the Arabian Peninsula and the Horn of Africa, he said.

“The Chinese government worries that there might be some day a political incident or conflict with the United States that would mean its trade is blocked across these straits,” Lasserre said. “So as to reduce this geopolitical risk, one way is to develop other trade routes, either maritime or land-based, to diversify the trade routes it can use to either import natural resources or to export its products to final markets.”

The other reason China is developing these trade routes is both economic and political in nature, he said.

“China is trying to develop closer economic relationships with its neighbours so it’s investing in building infrastructures – rail infrastructures, port infrastructures – to foster trade with these neighbours and to develop closer ties that can be economic and political, trying to build a so-called sphere of influence by developing dependence from these countries on Chinese economic exports,” Lasserre said.

“The possibility to build these fixed links, railway links or port infrastructures helps the Chinese influence to grow in these countries. So it’s both economics: gaining access to new markets and political: gaining political influence in these countries.”

Arctic Silk Road?

China has invested billions of dollars to acquire access to key railway and port infrastructure around the world, from the Port of Gwadar in Pakistan, to facilities near the Panama Canal, to the purchase of a controlling stake in the Port of Piraeus – Greece’s largest port – by COSCO Shipping, owner of the world’s fourth largest container fleet, and the company that wants to develop the deep-water port on the Northern Dvina River near Archangelsk .

The same logic of trying to secure access to the Golden Route or the route across the Panama Canal applies to Chinese interest in the Arctic, Lasserre said.

“They also want to try and develop the Arctic route just in case it might be useful from a commercial point of view,” Lasserre said.

Prof. Michael Byers, Canada Research Chair in Global Politics and International Law at the University of British Columbia, said the Arctic dimension of this ambitious strategy is relatively small for now.

“You have to look to Africa or Latin America to see the truly massive investments, hundreds of billions of dollars, in infrastructure and other forms of foreign investment,” Byers said in a phone interview with Radio Canada International.

Chinese investment in the Canadian Arctic

But while the Arctic is currently on the periphery of much of that investment, Byers said he expects Chinese involvement will grow if it maintains its vast stores of capital available for investment.

“Some of that will be related to newly opened shipping routes as a result of climate change – the Northern Sea Route, north of Russia, the Northwest Passage, north of Canada – and some of it will involve investments in resource industries,” Byers said. “Perhaps, in oil and gas in the Russian Arctic or the Canadian Arctic, probably in mining as well.”

Chinese companies already own a combined stake of 29.9 per cent in Russia’s $27 billion US Yamal liquefied natural gas (LNG) project.

Last year, the Yamal project signed loan agreements with Chinese banks worth over $12 billion US, circumventing Western sanctions over the crisis in Ukraine.

There has already been some Chinese investment in northern Canada, particularly in the Chinese-owned Nunavik Nickel Mine near Deception Bay, in Nunavik, northern Quebec.

In 2014, the company shipped 23,000 tonnes of nickel concentrate extracted from the mine using one of the most powerful ice-breaking bulk carriers in the world.

The MV Nunavik transited through the Northwest Passage on its voyage from Deception Bay, Quebec to northeastern China.

Is China interested in Port of Churchill?

“The more interesting question is whether the Chinese government or Chinese state-owned companies will wish to invest in infrastructure in Canada’s Arctic as they’ve done in other countries around the world,” Byers said.

“And there is certainly a need for ports in Canada’s Arctic, there is a need for improved services such as search and rescue, and one could imagine all kinds of public-private partnerships involving Chinese capital and Canadian governments, whether federal or provincial or territorial.”

For example, the Port of Churchill in northern Manitoba, which has been closed because OmniTRAX, the U.S. company that owns it decided that it’s not economically viable, could be of potential interest for the Chinese, Byers said.

“It’s possible that a big Chinese company might take a different view and wish to invest the necessary funds in Churchill to make it operational again and to develop Churchill as an artery for trade into the American Midwest from the Canadian Arctic,” Byers said.

A welcome investment?

If done in partnership with federal, provincial or territorial governments, this kind of Chinese investment in infrastructure will be welcomed in Canada, Byers said.

“I’m worried about other dimensions of Chinese investment particularly in sensitive military technologies – and there has been a record of lack of concern by the current federal government in some key investments in that area,” Byers said, referring to the recent take-over by a Chinese company of Vancouver-based Norsat International Inc.

“But in terms of building a port or a railway, investing in natural resource development I have far less concern and I would love to see the Canadian government engaging with major Chinese companies about the opportunities for partnerships to develop the Port of Churchill, develop a rail line, build a new port at Tuktoyaktuk, build a transshipment port at St. John’s, Newfoundland, to service the Northwest Passage.”

Lasserre, however, said he is not sure major Chinese investment in such key Arctic infrastructure would be met with much enthusiasm among certain segments of the Canadian population.

“Any Chinese endeavour in the Canadian Arctic is viewed with suspicion by a small part of the Canadian public opinion and by some circles in the Canadian government,” Lasserre said.

However, he said such opposition would be hard to justify given the government’s push to develop economic ties with China and the obvious need for massive infrastructure investment in the Port of Churchill and the rail line that leads to it from the Canadian Prairies and other parts of the Canadian Arctic.

‘Respect, cooperation and sustainability’

The Chinese embassy in Ottawa declined to say whether there is any interest by Chinese companies in acquiring the Port of Churchill.

When it comes to the Arctic, Chinese officials say the development of the region “concerns the future of mankind.”

“As a responsible major country, China has always put the common interests of mankind first,” the statement from the embassy said.

“China participates in Arctic affairs based on the three major policy principles of respect, cooperation and sustainability, and is committed to cooperate with related countries and organizations, enhance protection of Arctic ecological environment, continuously deepen scientific exploration in the Arctic region, rationally develop and utilize Arctic resources in accordance with law, and improve the Arctic governance system and mechanism, so as to jointly safeguard Arctic peace and stability.”

These principles are in line with the spirit of the ‘Belt and Road’ initiative, the embassy said.

In a statement sent to Radio Canada International, Merv Tweed, President, OmniTRAX Canada, said the company has not finalized the sale of the rail line and port assets.

“We’ve been very clear throughout the process that we’re willing to hear from any interested buyers,” Tweed said. “We will not provide details as to the current status of any sale negotiations, or the parties involved in those discussions, at this time.”

No quarrel with Beijing over the Northwest Passage

There is another advantage to encouraging Chinese companies invest in the Canadian Arctic infrastructure, Byers said.

Unlike the United States, China does not question Canada’s sovereignty over the Northwest Passage or Russia’s sovereignty over the Northeast Passage, or the Northern Sea Route, as it is also known.

“China doesn’t have any interest in challenging Canada’s or Russia’s claim because commercial shipping in order to be safe and efficient requires the close cooperation of the coastal state,” Byers said. “Chinese shipping companies need Canadian charts, they need Canadian weather and ice forecasting, they need Canadian search and rescue, and one day they will need access to Canadian ports.”

On top of that, China would be concerned about Canada losing its legal position in the Northwest Passage because Beijing has the exact same position with regards to the Hainan Strait between Hainan Island and southern mainland China, Byers said.

“Both Canada and China claim that their respective straits or passages are internal waters,” Byers said. “And both countries face the same legal opponent: namely the United States.”

This means that China has both practical and legal reasons not to undermine Canadian claims of sovereignty over the Northwest Passage, Byers said.

“It doesn’t want to have the negative precedent that would result if Canada were to lose its claim to the Northwest Passage,” Byers said. “That would hurt China with regards to Hainan Strait, that would be a detriment to China legally.”

In fact, when the Chinese government sent its icebreaker, Xuelong, through the Northwest Passage just a few weeks ago, it asked Canada’s permission, which was promptly granted, Byers said.

No competition to Panama Canal

In the meantime, Byers cautions that the Northwest Passage, which offers a 7,000-kilometre shortcut between Northeast Asia and the Atlantic seaboard of the United States, is unlikely to become anywhere near as important for maritime shipping as the traditional routes through the Malacca Strait or the Panama Canal.

“I don’t imagine that the Northwest Passage will compete in a significant way with the Panama Canal in my lifetime,” Byers said. “But I certainly expect that we will see first dozens and dozens more ships each summer and, perhaps, in the next decade or two, hundreds and hundreds more vessels. But those are tiny numbers compared to major shipping routes.”

Nevertheless, that means that Canada must work with countries like China and the U.S. to make sure that it has a safe route through the Arctic, he said.

Related stories from around the North:

Canada: How Arctic shipping could boost Canada’s trade relationship with Asia, Radio Canada International

China: China’s Belt and Road initiative moves into Arctic, blog by Mia Bennett

Finland: Nord Stream 2 applies for Finnish building permit to build gas pipeline, Yle News

Norway: ‘We will come back’, Statoil says after disappointing results in Barents Sea, The Independent Barents Observer

Russia: Chinese company confirms interest in trans-Arctic shipping to Arkhangelsk, The Independent Barents Observer

Sweden: Volvo to go all electric starting in 2019, Radio Sweden

United States: U.S. transportation secretary announces efforts to speed up project development in Alaska, Alaska Dispatch News