Dissent for N.W.T. carbon pricing plan heard at public meeting

Bill 60 would increase carbon taxes in the territory in accordance with new federal rules

There was a lot of frustration, a little bit of hope, and a pitch for renewable diesel heard at a public meeting in Yellowknife this week about upcoming changes to the N.W.T.’s carbon taxes.

The federal government is increasing the price on carbon pollution by a bigger increment every year, starting in April. It’s also banning rebates that directly offset the impact of carbon taxes — which is what the territory currently uses to ease the burden of the carbon tax on residents.

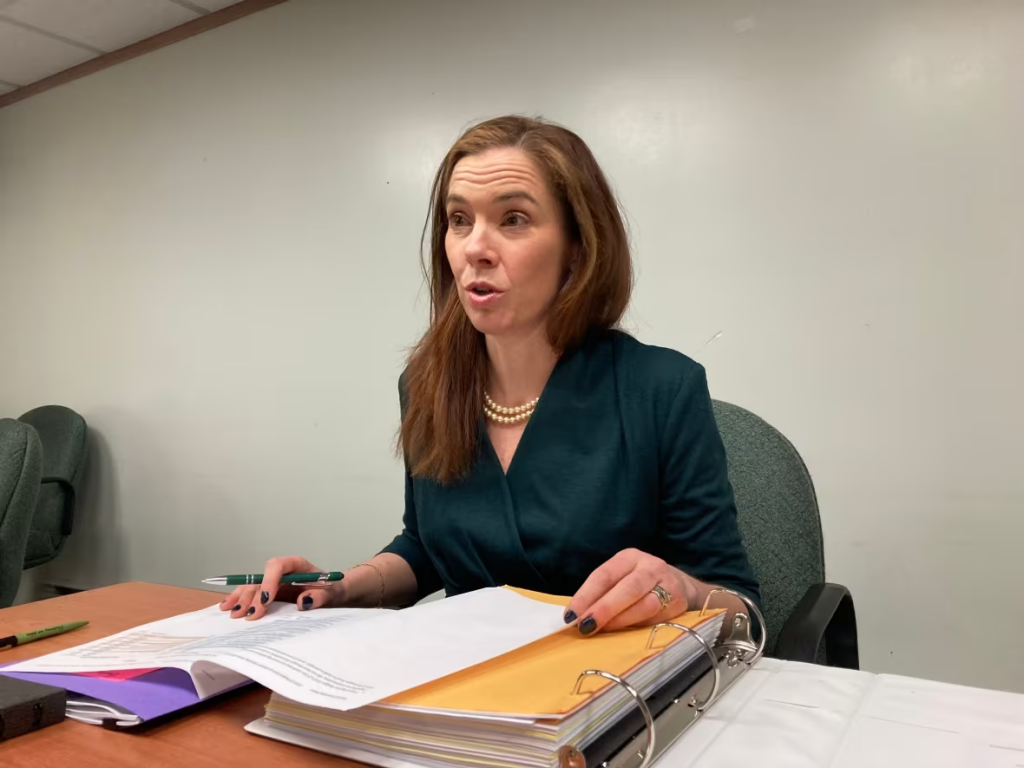

Finance Minister Caroline Wawzonek defended Bill 60, which is her response to the federal government’s changes, during the hearing at the legislative assembly on Monday. The bill would adopt the new federal rules but would also increase the cost of living payment to N.W.T. residents.

The cost of living payment is a quarterly cheque that residents receive after filing their income taxes.

Several MLAs at the meeting said they would not support Wawzonek’s bill. If it doesn’t pass, the federal government will force its changes anyway — and Wawzonek said it was unclear how, exactly, revenues would be returned to the territory.

“I can’t speak for the federal government. They have not clearly stated to us what they would do, other than … to say that the federal system would apply.”

Wawzonek said increasing the cost of living offset would return money to people based on average household costs and sizes in the N.W.T. — an effort that the federal government is “highly unlikely” to do as well.

“They’d make a payment to individuals, same across the N.W.T., as far as we are aware,” she said. “The system they have for large emitters would then apply as well, which would remove any ability that we have currently to be flexible for our industry.”

‘It really hurts’

Much was said Monday about how the carbon tax is going to make life harder for N.W.T. residents — and how increasing the cost of living payment would not do enough to offset the tax.

“Canada is trying to look good in front of the world leaders … on the backs of people here in the N.W.T. and it really hurts, especially when we have a high cost of living,” said Richard Edjericon, the MLA for Tu Nedhé-Wiilideh.

Katrina Nokleby, the MLA for Great Slave, said Bill 60 appears to be an issue about control, and that the territorial government wants to receive the carbon tax revenues so it can decide how to dole them out.

“I don’t always trust this government to make sure the money actually goes into the small community areas,” she said. “When I hear the alternative is that the federal government would just hand it out across the board, then I actually would support that.”

Nokleby also wondered why the Government of the Northwest Territories wants to have its own approach, when both the Yukon and Nunavut are “happy” with the system imposed by the federal government.

As explained later in the meeting by Kevin O’Reilly, the MLA for Frame Lake, the Yukon and Nunavut chose the federal system — but the money was returned to the territorial government and they were able to negotiate how the revenue was distributed back to people, businesses, local governments and industry.

Some talk of solutions

Mary Tapsell, who is on the advocacy committee for the Yellowknife Seniors’ Society, said it was difficult to compare the federal government’s carbon pricing system to the N.W.T. government’s — without much information about how the former would work.

Sara Brown, CEO of the Northwest Territories Association of Communities, said she was concerned carbon taxes are drawing further and further away from a promise to be “revenue neutral” for community governments — meaning there would always be rebates and offsets for the carbon tax.

“Our communities are already underfunded to the tune of 37 per cent and so there isn’t the capacity there to absorb these kinds of costs,” she said. That will force communities to increase taxes or reduce services, she said, noting that recreational programs might be among the first services cut.

Craig Scott, the former executive director of Ecology North, spoke as a member of the public and urged the committee to change the way it talks about the N.W.T.’s greenhouse gas emissions.

“We need to refrain from the discussion that the N.W.T. is just a small place and that we shouldn’t be responsible for our emissions,” he said. “If we say that, then every other jurisdiction on the entire planet can say the same thing and that means there’s going to be no action.”

Scott said the government could take revenues from the carbon tax and put it into solutions, such as sending wood pellets to communities above the treeline, developing a local wood harvesting industry below the treeline, investing in conservation, and transitioning toward electricity as a source of heat in the South Slave region.

The business Canada Clean Fuels also made a pitch to the committee for investing in renewable diesel, saying it could be used in the territory’s existing diesel-reliant infrastructure, that it would burn cleaner, and would reduce greenhouse gas emissions.

Regardless of whether the carbon tax in the N.W.T. is a territorial or federal system, it will start rising by $15 per tonne of carbon dioxide equivalent emissions every year starting on April 1. The price will start at $65 a year and reach $170 per tonne by 2030.

Related stories from around the North:

Canada: Cutting Yukon carbon emissions by 45% possible, with ‘wartime-like effort,’ council finds, CBC News

Greenland: Climate change accelerating ice loss from peripheral glaciers, Eye on the Arctic

Norway: Will the green transition be the new economic motor in the Arctic?, Eye on the Arctic

Russia: More Russian Arctic oil via Murmansk redirects to India, The Independent Barents Observer

Sweden: Sweden’s climate policies closer to reaching goals, Radio Sweden

United States: Bering Sea ice at lowest extent in at least 5,500 years, study says, Alaska Public Media