Canadian opposition may stymie G8 efforts to reduce tax evasion through the use of off-shore havens, according to advocacy groups. It’s estimated billions of dollars in unpaid taxes are lost every year by governments around the world.

Tax shelters are being made a priority of the upcoming G8 summit by the host, Prime Minister David Cameron of Britain. He will propose three measures. The first would crack down on beneficial ownership, whereby accounts are either numbered or in the name of someone other than the true owner, thereby ensuring secrecy.

Countries should automatically exchange tax information, proposes Cameron, and there should be country by country reporting of profits and taxes paid by multi-national corporations.

Canada could “scuttle” iniative

Canada appears to support the reporting of profits and taxes but not the measure on beneficial ownership. “That is a key one,” said Dennis Howlett, executive director of Canadians for Tax Fairness. “If you don’t have that a lot of the other measures that are being proposed won’t work.”

Why Canada would not support this measure is a mystery to Howlett because Canada is losing tens of billions of dollars of tax revenue as a result of tax havens. And he is concerned that Canadian opposition could “scuttle” the initiative.

says Canada could “scuttle” a deal.

“(G8) decisions are made by consensus,” said Howlett, “and they need most of the countries on board to agree to key points in a communique. So Canada is in a make or break position. If it supports Prime Minister Cameron we could have a really strong communique come out of the G8 which could then build the political will necessary to follow through with implementation by other bodies like the OECD or the United Nations. So Canada is in a key role here.”

Pressure on Canada

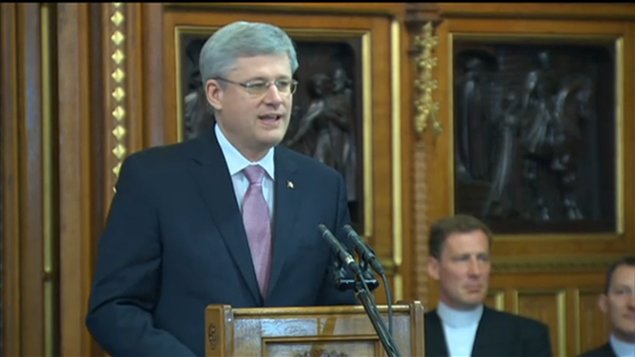

Pressure to approve all the measures to crack down on tax havens will be applied to Canada’s prime minister when he visits with the leaders of Britain and France before the G8 summit.

Pressure is also building at home from provincial governments which, too, are losing tax revenue though off-shore havens. Pressure will also come from the public which has learned about widespread tax evasion is through secret banking documents leaked to the public broadcaster, the CBC.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.