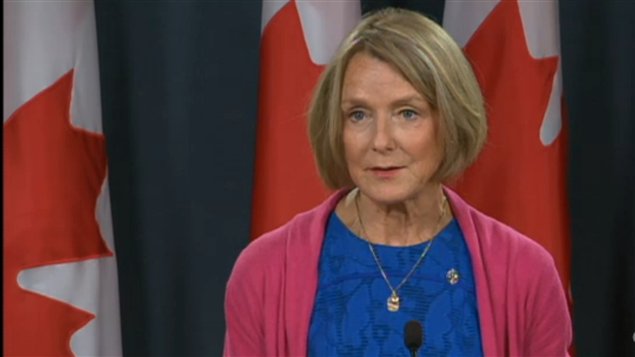

Canada’s credit unions should not be taxed like Canada’s banks, and certainly not almost double the rate, says Peggy Nash, the finance critic of the Official Opposition NDP party.

Earlier this year during the federal budget discussion, the NDP argued against a rise in tax rate from 11 to 15% on credit unions, but failed to convince the government. Now a report by the financial advisory company Deloitte suggests wording in the legislation will actually raise the tax rate on credit unions to 28%. That’s almost double the rate on Canada’s backs.

Credit unions are member owned financial cooperatives.

RCI’s Wojtek Gwiazda spoke to Peggy Nash to find out more.

More information:

NDP press release – Conservatives more than double taxes on credit unions – here

Deloitte – Bill C-60 Economic Action Plan 2013 Act – impact on cooperative financial institutions – here

Update (August 28): Canadian media is quoting the office of Finance Minister Jim Flaherty as saying the “technical issue [] was already identified” and “Minister Flaherty has committed to fix it as soon as possible and ensure no credit union is disadvantaged.”

RCI sent a request for details on what, how and when this will be done. In the exchange of emails with the Minister’s office the following from a spokesman: “The plan is for legislation this Fall.” and “Tax rate will be 15 per cent retroactive to introduction of the budget.”

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.