A new poll commissioned by the Canadian Imperial Bank of Commerce (CIBC) finds the overheated housing market is creating some indecision among home owners as to whether to sell, buy, or stay as they are.

The poll was to determine house ownership intentions.

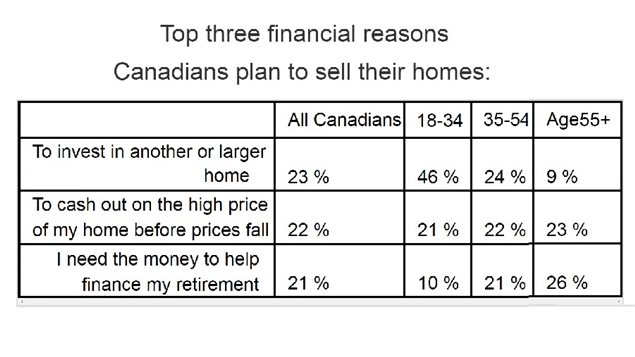

It found that 41 percent of homeowners who say they intend to sell, would do so to cash in on the high prices and reap a profit.

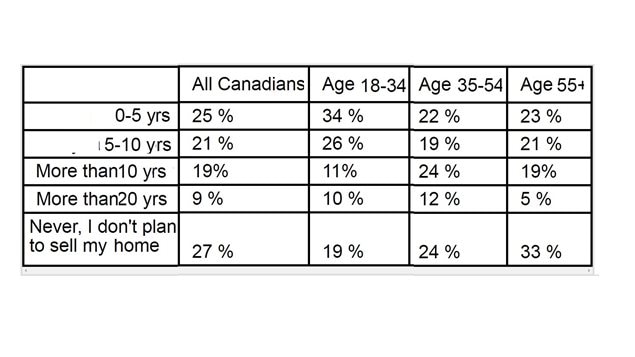

In terms of various age groups, 67 percent of those aged 55 and over say they would sell in order to downsize to a smaller home, condo, or nursing/retirement home.

As for millenials (aged 18-34), about 31 percent have bought a home, while 61 percent rent or live with parents or other family members.

Of the latter group, 23 percent fel they’ll never own a home,and 29 percent aren’t sure if they can or will ever try to buy a home.

Meanwhile, of millenials who do own a home the majority plan to sell,81 percent.

Some 63 percent say the costs of the mortgage and upkeep are making them cash poor. Another 57 percent mention that if interest rates rise they won’t be able to make mortgage payments.

Still, two in five say they’ll sell to upgrade to a bigger house.

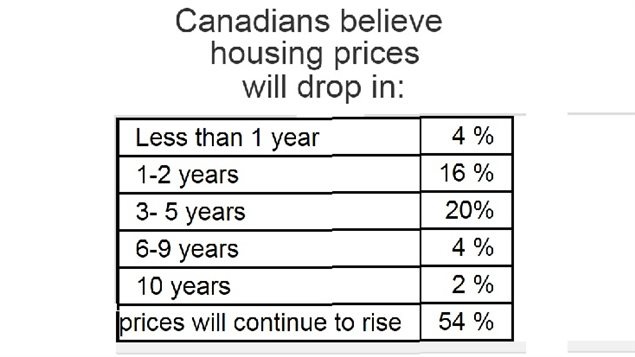

Many have been predicting for years that the housing bubble will burst, but 54 percent of respondents believe prices will continue to rise.

An earlier CIBC poll in February found that nearly half of Canadians retired earlier than expected, with 33 percent saying it was due to unexpected health issues, while 22 percent were asked to retire by their employer.

They also found that unexpected costs, health issues, and higher than expected taxes were unexpected surprises in retirement.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.