A new survey suggests that more than half of Canadians are on the brink of insolvency.

The survey, taken by Ipsos for MNP Ltd., found that 53 per cent of respondents said they were $200 or less away from not being able to meet all of their monthly bills and debt obligations.

The figure is a 10-point jump from a similar survey in December and is a five-year high the agency’s Consumer Debt Index.

It includes three in ten (30%) respondents who reported they are already insolvent with no money left at month-end to cover their payments.

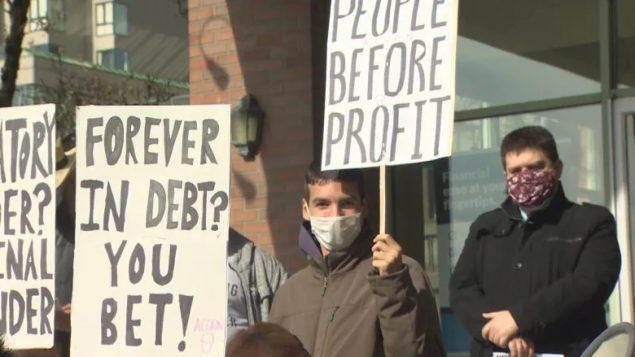

The new survey found that that 53 per cent of respondents said they were $200 or less away from not being able to meet all of their monthly bills and debt obligations. (THE CANADIAN PRESS/Graeme Roy)

“We saw that pandemic-related financial relief measures provided some breathing room over the last year, but now we’re seeing a reversal,” Grant Bazian, president of MNP LTD, said in the report published Thursday.

“The number of Canadians with virtually no wiggle room in their household budgets has reached a five-year high,” Bazian’s report reads.

“The anxiety Canadians are feeling about making ends meet – or already being unable to do so – tells us we may eventually see an avalanche of households falling behind on payments or defaulting on loans, mortgages, car payments or credit cards.”

On average, Canadians said they were left with $625 after making their payments, down by $108, or 15 per cent from December, according to the report, which said the decline is likely a reflection of the government aid programs, eviction bans, and debt holidays given by lenders that are now coming to an end.

“Some Canadians may be seeing their bills becoming due, even if they are not back to full-time employment,” Bazian wrote.

“Even though some Canadians are spending less and saving more as a result of pandemic measures, others are being pushed further into the red, taking on more debt to stay afloat after job, wage, or small business loss.”

The survey found that a quarter of Canadians said they had taken on more debt as a result of the pandemic.

The survey found that among respondents, 20 per cent said they used savings to pay bills, 14 per cent used credit cards, seven per cent used a line of credit, while three per cent took out a bank loan or deferred mortgage payments.

(Getty Images)

Among respondents, 20 per cent said they used savings to pay bills, 14 per cent used credit cards, seven per cent used a line of credit, while three per cent took out a bank loan or deferred mortgage payments.

“Those taking on more debt are becoming increasingly vulnerable to interest rate increases in the future. They might find that their debt becomes unaffordable when that happens,” Bazian wrote.

The study found that over half of respondents (51%) were concerned about their ability to repay debts if interest rates rise while about 35 per cent were concerned that rising interest rates could move them towards bankruptcy.

“The anxiety Canadians are feeling about making ends meet – or already being unable to do so – tells us we may eventually see an avalanche of households falling behind on payments or defaulting on loans, mortgages, car payments or credit cards,” Bazian says in the report.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.