The Bank of Canada will likely stay its course on keeping interests rates low despite the increase in January’s inflation numbers, says Avery Shenfeld, Chief Economist at CIBC Capital Markets.

The cost of living in Canada increased to 2 per cent in January, recording the highest annual rate in more than a year, Statistics Canada said Friday.

The federal statistics agency reported that Canada’s inflation rate is now at its highest level since October 2014. In December, the Consumer Price Index was 1.6 per cent.

“The Bank of Canada is willing to look past that,” said Shenfeld. “It argues, I think rightly, that we are going to see this one-time pass through into consumer prices from the weaker Canadian dollar, but it’s not going to be ongoing inflation, as long as the Canadian dollar levels off at some point.”

(click to listen to the interview with Avery Shenfeld)

ListenIn fact, at 2 per cent inflation was right on the Bank of Canada’s target, said Shenfeld.

For the first time since oil prices began plummeting in late 2014, gas prices were the biggest contributor to the increase, as consumers paid more for gas in in January than a year earlier.

“What happened is that gasoline prices are cheap now but they were as cheap a year ago,” said Shenfeld. “That had been an earlier reason why inflation looked so light and it’s pretty much vanished now from the 12 months rate of inflation.”

Higher fruit and vegetable prices were also a factor, climbing up 18 per cent annually in January after rising 13 per cent in December.

The other fresh vegetables index, which includes broccoli, cauliflower, celery and peppers among other products, registered its largest year-over-year increase of nearly 23 per cent since April 2009, the agency said.

Meat prices rose less in the 12 months to January than in December. Prices for food purchased from restaurants were up 2.5 per cent year over year in January, following a 2.8 per cent increase the previous month.

One area that saw a surprising price decrease was clothing, Shenfeld said.

And because Canadians do import a lot of clothing, that may be a sign that price hikes from the weaker Canadian dollar are still to come in that sector, Shenfeld said.

“Retailers order clothing well in advance of when it appears in the store so we’re going to see, I think, some upward pressure on clothing prices,” he said.

But on the other hand, food prices are expected to go down in the coming months, Shenfeld said.

Food prices are always influenced by production and weather cycles, he said.

“While the headlines about some of these food prices were screaming about the weak Canadian dollar, there was a little more behind it in terms of even in U.S. dollar terms some of these prices had spiked higher and may now be cooling off a bit,” Shenfeld said.

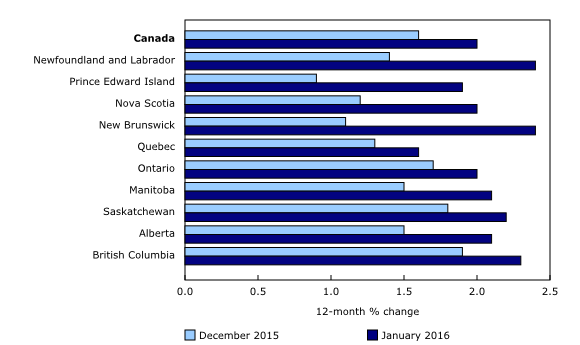

In all provinces, consumer prices rose more in January than in December on a year-over-year basis, with Newfoundland and Labrador and New Brunswick posting the largest gains.

- Source: Statistics Canada

With files from CBC News

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.