Canada’s annual inflation rate cooled slightly last month to 2.2 per cent after having increased to 2.3 per cent in March, Statistics Canada reported Friday.

The federal data agency’s inflation reading for April came in a little lower than predicted by most economists who were expecting it to stay at 2.3 per cent.

“We saw some evidence of underlying inflation accelerating earlier this year—seasonally adjusted prices excluding food and energy were up an annualized 2.7 per cent in the first quarter — but that wasn’t the case in April with core prices coming in flat month-over-month,” said Josh Nye, economist with RBC Economics Research.

The upward pressure on inflation last month was led by higher costs for gasoline, air transportation and restaurants, while the biggest downward forces came from cheaper prices for digital equipment, travel tours and natural gas.

Gasoline prices have risen by 6.3 per cent in the past 12 months, the data agency said.

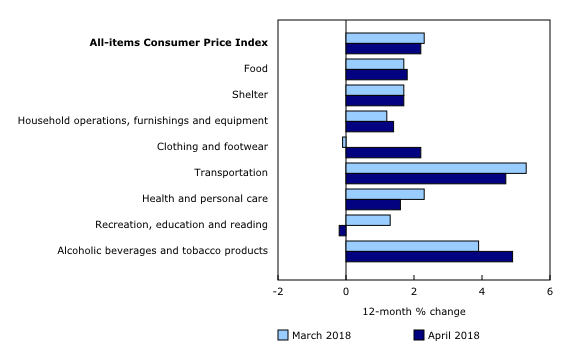

Consumer prices increased in seven of eight major components in April. (Statistics Canada)

The report also says the average of the Bank of Canada’s three measures of core inflation, which omit more-volatile numbers like pump prices, crept slightly above the two per cent mark last month for the first time since February 2012.

The central bank closely monitors inflation ahead of its interest-rate decisions and it can use rate hikes as a tool to help prevent inflation from climbing too high.

“With a relatively benign inflation outlook, the Bank of Canada will remain focused on the risks to the Canadian economy, namely headwinds to growth from a slowing housing market and uncertainty around NAFTA, which, as of today, looks to remain a thorn in the side of policy makers for some time to come,” said James Marple, senior economist at TD Bank Group.

With files from The Canadian Press

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.