It seems Canadians generally feel a recession is likely this year, but some economists are not of the same opinion.

A poll for the Bloomberg news agency by the Nanos Research group in late November and early December found 56 per cent of Canadians felt that a recession was ‘likely or somewhat likely’ while 34 per cent felt a recession was unlikely or somewhat unlikely ( 10 per cent were unsure)

The hybrid telephone and online random survey of 1.010 Canadians found the highest level of pessimism in western Canada where the prominent energy sector (oil and gas) has been suffering, and its been a difficult year for agriculture as well.

The Canadian dollar last year at this point was at .75 cents U.S, and for the last 2 weeks has been relatively stable at .77 cents ( Morningstar for Currency and Coinbase for Cryptocurrency)

Another somewhat related poll in October after the federal election found a mere 22 per cent of Canadians had confidence in Prime Minister Justin Trudeau’s ability to improve the economy. In its most recent adjustment, the Bank of Canada has held it’s rate steady saying the economic conditions while uncertain have not so far shown signs of decline but instead have shown some promise. Many other central banks have lowered there rates in recent months. Canada’s economy is expected to grow by a very modest 1.6 per cent.

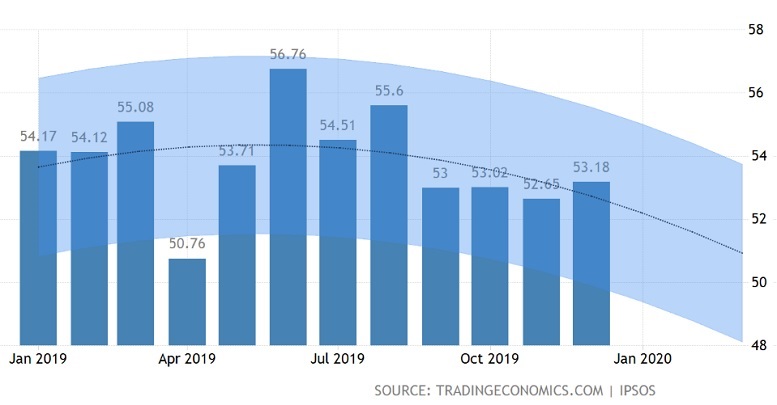

Canada’s consumer confidence index is projected to show a very slight decline as well. The index is rated on a scale of 0 to 100 where 0 is an extreme lack of confidence, 50 is neutral and 100 is extreme confidence. Projections are for the rating to average 54 points this year.

In Canada, the Index of Consumer Confidence is calculated from the combination of responses to a number of surv questions including:

- – current state of the economy in the local area and in the country and its expected state 6 mths ahead;

- -current personal financial situation and the expected situation 6 mths ahead;

- -making a major purchase like a home or car now compared to 6 mths ago;

- -making other household purchases now compared to 6 mths ago;

- -confidence about one’s own and relatives’ job security

- -ability to invest in the future and save money for retirement now compared to 6 mths ago

- -losing job as a result of economic conditions in the last 6 months and in the coming 6 mths

The Consumer Confidence Index from Trading Economics shows a slight decline is in the offing for 2020

In spite of a strong housing market and an uptick in wages and low unemployment an economist with Canada’s ScotiaBank says the economy will be ‘mediocre’ in 2020, but is doubtful of a recession. That is echoed by Bloomberg economists who say the economy will be ‘lacklustre’ this year.

The drag on the economy comes from Canadians who are carrying some of the world’s highest household debt and who have reduced spending in 2019 to the lowest level since 1962.

This is not good news in an economy that depends in substantial measure on consumers to push growth.

Additional information-sources

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.