As fears over the covid-19 virus rise, and the economy slows, financial experts are predicting that bank rates may be lowered to help economies.

The Organisation of Economic Co-operation and Development (OECD) downgraded its global GDP outlook saying the economic effects of the virus are having a major effect, but if the virus spread and outbreaks do not fade, then economic effects will be severe. It’s outlook, based on a short-lived outbreak, still notes that growth could be cut in half in the report entitled “ Coronavirus- The world economy at risk”

It advised global co-ordination action if growth is much weaker for an extended length of time. This could be translated as an advisory toward a lowering of interest rates.

A global lowering of rates is expected in coming weeks.

This morning in a surprise announcement the U.S Federal Bank announced a large 50 point rate cut while the Reserve Bank of Australia today announced cuts to a new record low of 0.5%.

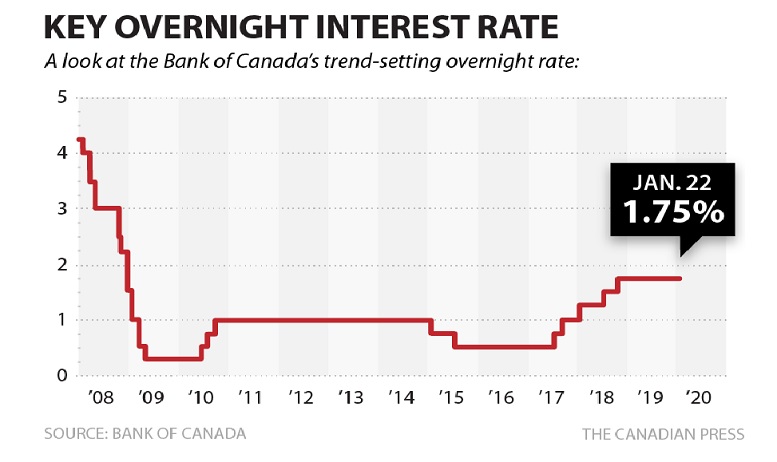

In Canada, where the central bank has been holding the lending rate steady since October 2018 at 1.75%, pressure is mounting for a cut. Unlike other G7 countries, Canada had resisted lowering interest rates over the past year.

Until now, the Bank of Canada has resisted pressure to lower interest rates. That may change this week. (via CBC)

Now, in the face of a slowing in growth it had been expected that Canada’s central bank might announce a cut in its April announcement. However, the effect of the covid-19 virus as it spreads worldwide and reduces product demand and output is changing economic forecasts.

it’s now anticipated that Bank of Canada Governor Stephen Poloz may make a surprise rate cut this week from the central bank (Sean Kilpatrick-CP)

As Bank Governor Stephen Poloz prepares to leave the post in June, it is now expected that in the face of such things as a steep drop in oil prices and panic stock sales, that the Bank of Canada may announce a quarter point cut this week with another cut possible in April when it releases its Monetary Policy Report. The effect of the many rail blockades on the economy has not yet been figured into an already weak Canadian economy.

Analysts are even predicting a three-quarter percent cut by the end of the year.

Additional information-sources

- Bloomberg: E. Hertzberg: Mar 2/20: Virus Rate Cut Could Open Poloz’s Bank of Canada Finale

- CBC: D. Pittis: Mar 3/20: Bank of Canada may cut rates to aid economy sickened by COVID-19: Don Pittis

- RTT (via Nasdaq): Mar 2/20: OECD Cuts Global Outlook On Severe Impact From Covid-19 Outbreak

- Canadian Mortgage Trends: S. Heubl: BoC Increasingly Likely to Deliver a Surprise Rate Cut This Week

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.