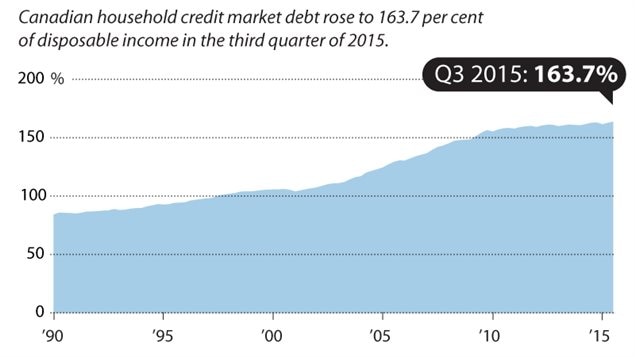

The personal debt load of Canadians rose to close to 164 percent by late last year according to Statistics Canada, the federal statistics agency.

That means that for every dollar of disposable income (after taxes and necessities) they owed $1.64.

By the end of the third quarter last year Canadians were carrying mortgage debt of $1.234 billion, and credit debt of $572.3 billion and other debts combined, Canadians owed a total 1.89 trillion dollars by the third quarter last year.

Economists have been sounding the alarm on that situation for the past few years saying that if lending rates, and mortgage rates go up, a great many Canadians will find themselves in serious trouble.

The old saying is often mentioned that you shouldn’t spend more than you make.

But who is telling governments?

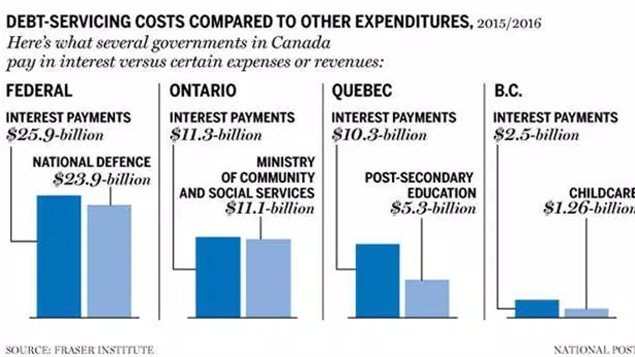

The Fraser Institute is a conservative-leaning public policy think-tank. According to their new report on debt loads, combined federal and provincial government debts are likely to total $1.3 trillion this year.

The current government says it will stimulate growthe by investing in infrastructure projects. It will have to borrow billions of dollars to do that. Some say that if you’re going to do that, now is a good time while interest rates are low. Others however say it’s risky with the current net debt- to- Gross Domestic Product (GDP) ratio at almost 65 percent.

The federal debt is currently approaching $700 billion. At the current debt level, interest payment is 26 billion dollars a year..

That’s about $2 billion more than the government spent on national defence.

Economists say the same holds true for the Canadian government as it does for citizens, the debt should come down before interest rates increase and that they say, is not a question of if- but rather –when.

Additional information- sources

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.