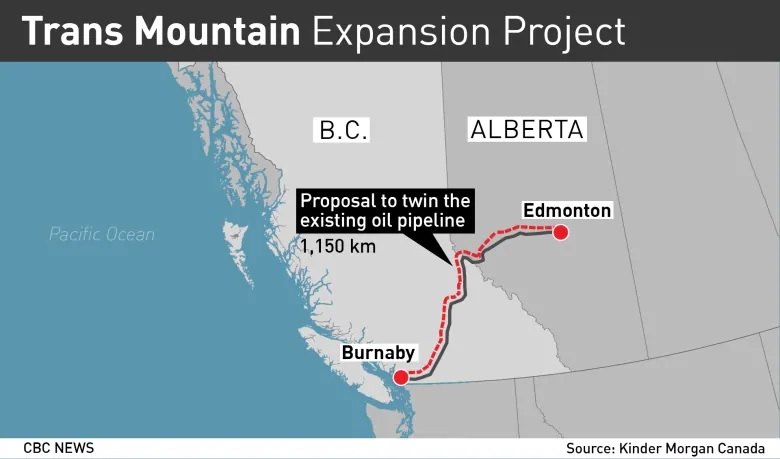

In 2018, faced with large-scale protests and legal delays, U.S,-based KinderMorgan said it had had enough and would halt its ‘Trans-Mountain’ pipeline project from Alberta to the British Columbia Pacific coast.

The massive project was to twin a decades old existing line to increase capacity for shipping Alberta’s tar sands oil. The Trudeau Liberal government stepped in and bought the Canadian line and the project saying it was in the national interest, and paid $4.4 billon in a deal quickly accepted by shareholders. The government said it would then sell the pipeline project or completed line. So far there have been no buyers.

It’s now estimated the expansion project will cost some $12.6 billion by the planned completion date of December 2022.

The TMX project would increase the shipping capacity from its current 300,000 barrels per day to 890,000 barrels per day.

There have been questions whether the expansion project will even be necessary with the worldwide demand for oil decreasing. One of the world’s largest oil companies, BP, recently indicated that it felt the demand for oil had peaked and from now on would begin a slow decline. BP said it was reducing its investment in oil and shifting towards renewable energy technologies.

This week Canada’s Parliamentary Budget Officer said at its current valuation the government could make some $600 milllion profit, but then also suggested support for concerns about the pipeline investment.

The new pipeline will run 1,150 kilometres along much of the route of the existing line., built in early 1950 The twinning of the existing pipeline would nearly triple its capacity to an estimated 890,000 barrels a day and increase traffic off B.C.’s coast from approximately five tankers to 34 tankers a month. (CBC News)

In a study released this week by the budget watchdog, Yves Giroux, said the line is still profitable if based on current long term values. However, that could change due to a number of ‘risk and uncertainties’ about the future.

These include a decline in oil demand, construction cost increases, construction delays, changes in contract obligations, and the government’s own climate and environmental policies as it moves to implement greenhouse gas emission targets.

Greenpeace Canada reacted with a statement saying, This pipeline is only profitable in a worst-case climate scenario, where the world takes no new action on climate change. That is not a future that we should be betting over $12 billion dollars of public money on.”

Parliamentary Budget Officer, Yves Giroux (Adrian Wyld- CP)

Trans Mountain says it has contracts for 80 per cent of the line capacity for at least the next 15 to 20 years. Giroux notes that other countries are setting greenhouse gas targets as well which would in many cases affect pipeline demand beyond that timeline.

A report by the Canada Energy Regulator notes that in an ‘evolving’ scenario where climate concerns and emissions controls are increased, oil demand would decrease around along with demand for pipeline and rail capacity to export the oil. By 2040 with fewer contracts, the value of the line decreases

In one of Giroux’s scenarios, if Canada reaches its net-zero emissions goal as promised by mid-century, the line would cease operation. The budget watchdog says the resulting value loss would be around $1.5 billion.

On its website The Canadian Association of Petroleum Producers says International Energy Agency predictions are that world demand for heavy oil will increase by seven per cent by 2040.

Environment and Climate Change Canada says that the project does not change Canada’s emissions estimates or goals. It says the completed project’s approximately 400,000 tonnes of annual emissions from operation and shipping port activities, were already added into the original calculations. The ECCC says the figure has already been taken into account in the climate plan.

Additional information- sources

- Canadian Press (Huffpost) J Press: Dec 8’20: Feds could lose money on Trans Mountain if climate plans strengthened: PBO

- iPolitics: J Lim: Dec 8/20: Trans Mountain’s profitability depends on climate action, says budget watchdog

- CBC: D Thurton: Dec 8/20: ‘Risks and uncertainties’ could make Trans Mountain unprofitable, says budget watchdog

- CAPP- world energy needs

- ECCC: Greenhouse gas emissions from the Trans Mountain project

- Greenpeace Canada statement

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.