No tax increase…for the moment

With the emergency health orders restricting movements, closing businesses, and causing massive disruption to social and economic life, the government has been spending vast sums to soften the blow.

However that massive spending by the federal government and revenue losses means a huge increase in the debt. The revenue loss and debt is also being heavily felt by provincial and municipal governments.

Due to those various emergency bridging funds and tax deferral programmes, the deficit this year was estimated to be over $250 billion by the Parliamentary Budget Office. But that was on April 30, and should be revised higher.

$400 million deficit, trillion dollar debt possible

The Financial Post reports that on Wednesday analysts at Macquarie Capital Markets Canada estimates the deficit could be closer to C$400 billion which would push the debt to GDP ration to 55 per cent.

With provincial states of emergency declared many shops closed up, putting millions out of work. With no income, some have since closed permanently (Ben Nelms-CBC)

They caution that at that rate Canada’s AAA rating on global markets could be jeopardized, especially if the economy does not recover and under-performs in 2021

The PBO said that a federal debt of a trillion dollars is “not unthinkable”. Although two of the four major bond rating agencies have relisted Canada’s top rating, two others have not. A drop in the rating could increase borrowing costs which could have a major effect on the ability to pay the interest and further increase pressure for tax increases and service cuts.

As to how to pay it off, the typical responses are a combination of increased taxes and cuts in public sectors and in services.

When asked about this, the Minister of Finance, Bill Morneau said the possibility of increased taxes or other measures is not something the government is concerned about right now. Speaking to a CBC TV host yesterday he said “ “What we’re thinking about is preserving our economy for the future, making sure that we can get back to a vibrant place.”

However the government did proceed with its carbon tax hike on April 1, increasing tax from $20 to $30 tonne, which translates to about a hike of about 6.6 cents /litre according to the non-profit advocacy group, the Canadian Taxpayer Federation. “The federal government hammered Canadians with a carbon tax hike during a health and economic crisis while our international peers are freezing or reducing their carbon tax burdens,” said Aaron Wudrick, Federal Director for the CTF.“There is no worse time to hike taxes than during an economic downturn,” said Wudrick.

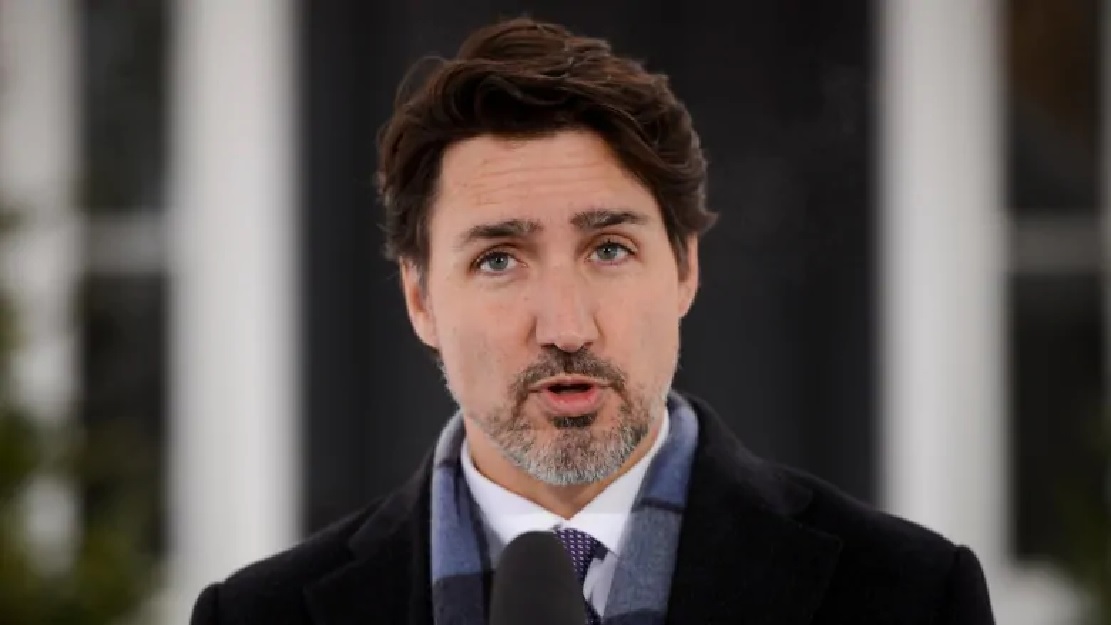

Prime Minister Trudeau has created several financial plans to soften the economic downfall, but by some estimates that will result in a massive deficit of up to $400 Billion. (Sean Kilpatrick- CP)

In terms of federal economic plans, the government was supposed to release a budget at the end of March, but the coronavirus disrupted those plans. Pushing aside opposition requests for some sort of financial update, Prime Minister Trudeau said the government is concerned with immediate needs not long-term planning. He added that a budget is based on a yearly estimate of economic activity, and any predictions now are impossible.

Ontario, the country’s largest provincial economy which currently has the largest sub national debt will see its debt grow considerably as that economy suffers a drop of about 9 per cent this year from the effects of the state of emergency, shutdowns, and revenue drops.

Quebec, the second largest of provincial economies, had been running surpluses until the virus. The provincial finance minister, Eric Girard said this week however, that the province is on track for a $12 million to $15 million deficit. Yesterday he said it may take five years for the province to get back on track.

additional information – sources

- PostMedia: J.Ivison: Mqy 13/20: Ottawa’s COVID-19 debt binge brings very real risk of ruining the next generation

- BNNBloomberg: May 13/20: Soaring Canada deficit may jeopardize AAA rating: McQuarrie says

- CBC : JP Tasker: May 13/20: Liberal government ‘not thinking’ about raising taxes right now, says Morneau

- Wall Street Journal : S. Harper (former PM)” May 12/20: OpEd: After Coronavirus governments will have to shrink

- BNNBloomberg: S.Rastello: Mqy 13/20: Quebec says it may take years to balance books after virus

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.