This is not news to Canadians who’ve been paying taxes for years but a new report puts actual figures to what they already know anecdotally: more and more of their money is going to taxes.

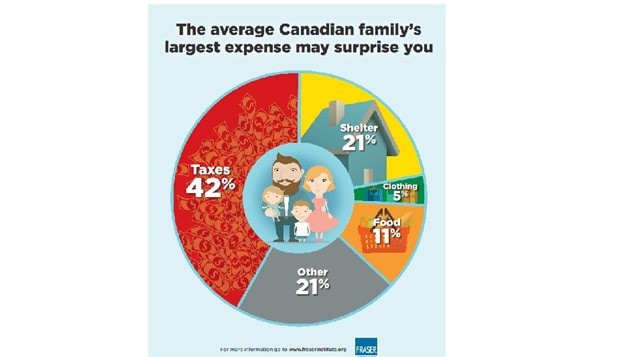

A report from the economically conservative and libertarian-leaning think-tank, The Fraser Insistute says Canadians now pay more in taxes than they do for food, shelter and clothing combined.

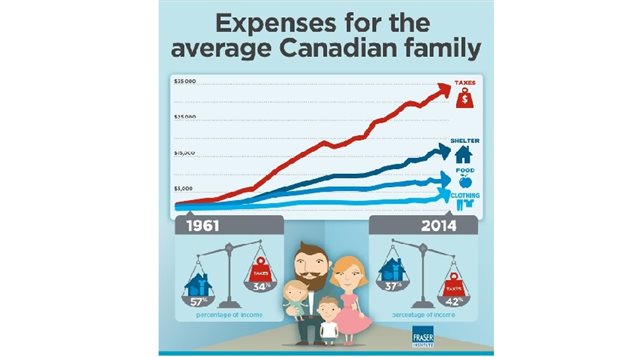

The report says that in 1961, some 34% of Canadian salaries went to taxes, but by 2014, 42% of their earnings went to the government.

According to the study, the average Canadian family in 2014 earned an income of $79,010 and paid total taxes equaling $33,272 (42.1%) ,compared with the 1961 average income of $5,000 and a total tax bill of $1,675 (33.5%).

Charles Lammam is co-author of the Canadian Consumer Tax Index study.

Quoted in the National Post newspaper he says, “As the tax bill grows, there is less money available for families to spend on things they want to spend on, to save for retirement or their kids education, or even to pay down their household debt,”

The report notes that the average family tax bill rose by 1,886 percent between 1961-2014, while average income rose by only 1,480 percent.

The tax rate increases also greatly surpassed increases in food costs (561 percent) and clothing (819 percent). Housing/shelter costs rose 1,366 percent.

The study says that even after taking inflation into account taxes have risen 149.2 percent.

The report notes also that in recent years taxation has not equaled government spending and that governments have borrowed to make up the difference through deficit budgets. The report says this money must be paid back so deficit budgets must be considered as deferred taxes. Taking that into account, taxation rates would be even higher at over 44 percent.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.