It is tax time in Canada. If you owe the government money, you have to file a tax return by April 30th every year. Because that falls on a weekend this year, 2016,, you have until May 1st, Monday to file. If the government owes you money, you can file later.

However, understanding the tax laws can be tricky.

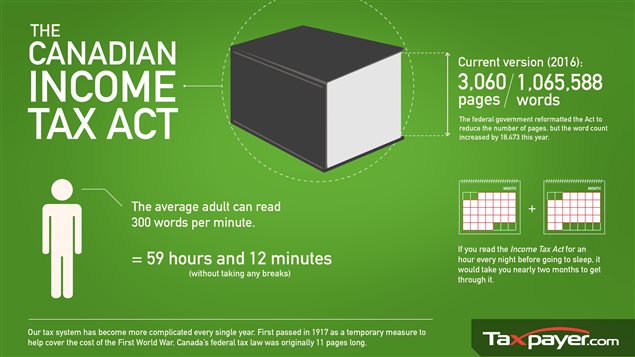

This year Canada’s tax law is now 3,060 pages and over a million words long.

Aaron Wudrick of the not-for-profit advocacy group, Canadian Taxpayers Federation says, There is no doubt that our tax system has become increasingly complex over the years, to the point of absurdity”.

First tax act- 11 pages

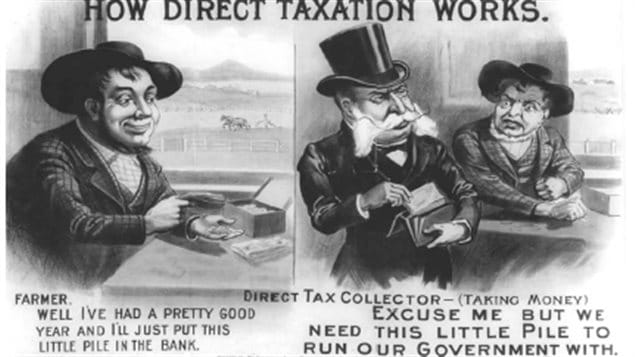

In 1917, the First World War had already been dragging its deadly heels for three years. Horrifically costly in lives, it was equally costly in money. The federal government’s revenue at the time came from postal sales, customs and excise, and miscellaneous other sources.

With the outbreak of war, sales of Victory Bonds added to the stream, and there was a new Business Profits war tax. But it was hardly enough.

Under the British North America act, basically Canada’s first constitution, it was the provinces and not the federal government which had jurisdiction to make laws regarding “direct taxation”.

The cash-strapped federal government which had responsibility for national defence, then used its powers regarding military and defence matters under the BNA Act to create a new income tax. As Canada was fighting a war for Britain, the governor-general (the King’s representative) eagerly gave Royal Assent to the “temporary” measure. Royal Assent was and is necessary for a bill to become law in Canada.

From the tax act guide of 1917

“It is a new departure in Canadian methods of raising money for federal purposes. It affects all incorporated companies, associations, partnerships, trustees and persons, whether male of female, having an income of fifteen hundred dollars in the case of unmarried persons and widows or widowers without dependent children, and three thousand dollars in the case of all other persons”.

In years after the war, the tax continued in spite of calls for it to be repealed as the war was over and war debts paid, theoretically now making the tax illegal. But, government and its bureaucracy had grown along with expenses, and the calls were ignored.

Then as the Second World War approached the same need was there and no thought of revoking the law.

By 1948, the tax law was revised and expanded , although there seems to be no record of Royal Assent, again theoretically meaning there is no “law” to tax citizens. For comparison sake, while the 1917 tax act was 11 pages in length, the 1948 Act had increased to 88 pages, still a far cry from the 3,060 pages of today.

During that course of time, successive governments have added amendments and created various tax niches, each time boosting the wording and complexity.

As for the latest tax act with its thousands of pages in length, the CTF says the current government “… has indicated a willingness to review the tax code,” added Wudrick, “They would do well to remember that a simpler, lower, flatter system will reduce the amount of time and resources that must be spent by both Canadians and the CRA to ensure compliance with the Act”.

additional information-sources

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.