A recent national survey indicated that nearly a majority of Canadians were concerned about their ability to repay debts with a third saying they didn’t earn enough to cover debts and obligations.

On the heels of that survey, just a week later comes another survey, this one by the Angus Reid Institute , showing Canadians owe nearly twice as much as they earn.

, showing Canadians owe nearly twice as much as they earn.

In actual numbers, for every dollar of disposable income, (money left after paying necessities, like housing, clothes, food) Canadians owe $1.78.

Combining the debt of all Canadians equals $2 trillion.

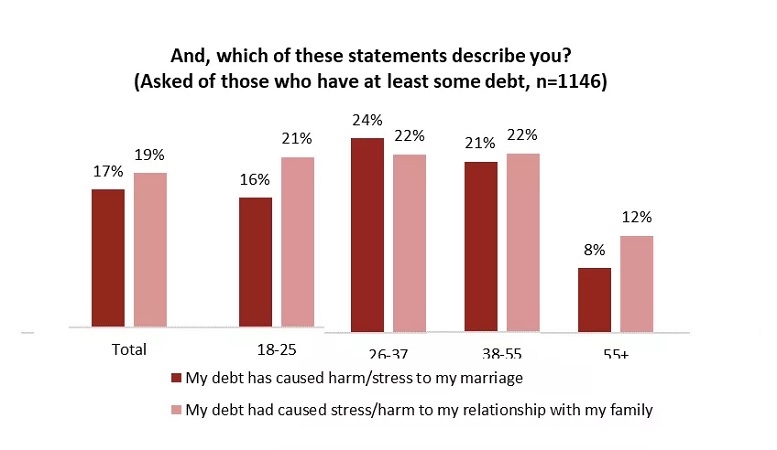

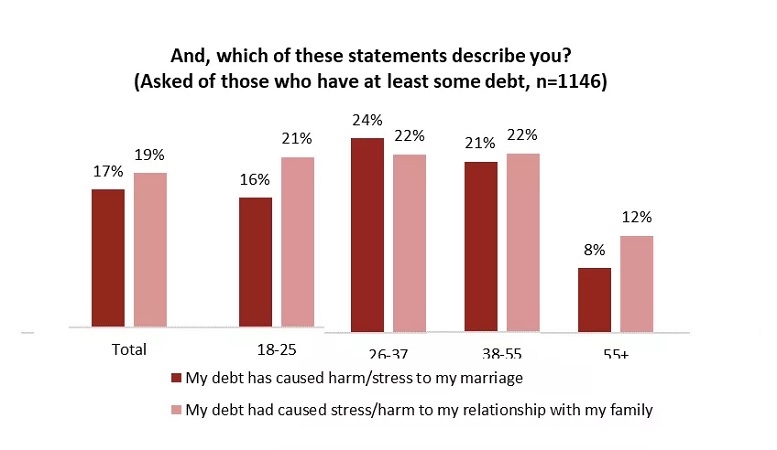

The study also echoes several other studies where respondents have said that money concerns are causing them stress. Younger Canadians are also concerned about their ability to find and hold on to good jobs.

A third of Canadians say they aren’t saving for retirement because of their debts.

Other effects of the heavy debt for millions more Canadians, especially under age 40, say their debts mean they haven’t been able to buy a home, while others say they’ve put off, getting married, or having children. Many young adults have to continue living in their parents homes.

Some nine in ten respondents said it’s stupid to go into debt if you don’t have to and yet, 76 per cent say they are carrying debt, while 24 per cent say they are debt-free.

Of those carrying debt, 16 per cent say the debt is difficult to manage, while 39 per cent say it is significant but manageable.

Only 12 per cent of Canadians say they have enough money to meet or exceed their personal goal.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.