The Parliamentary Budget Office (PBO) has released a shocking report for Canadians. The Liberal government deficit spending will have reached just short of $25 billion in the fiscal year 2019 which ends March 31, almost all of it prior to the COVID-19 crisis.

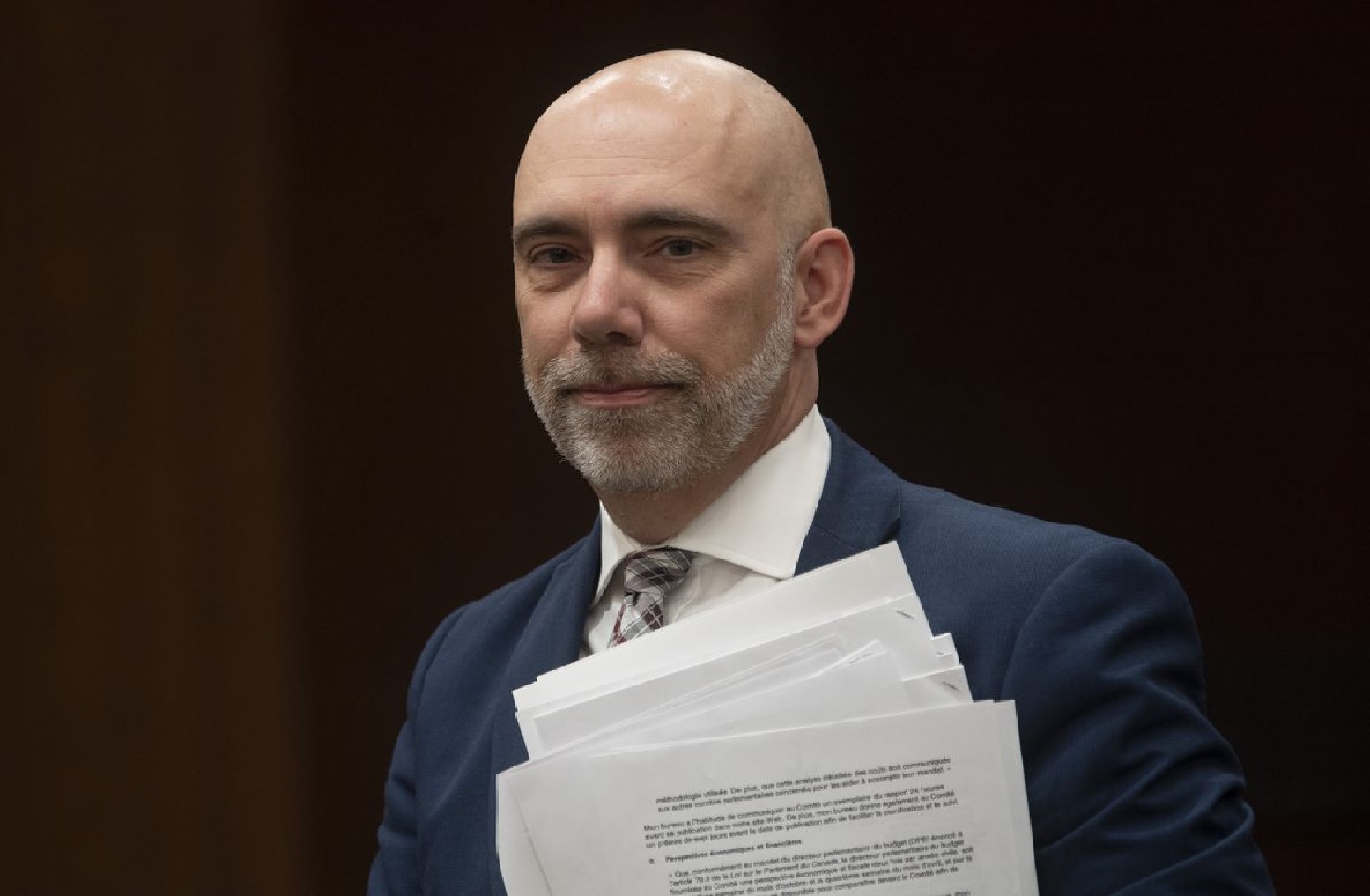

Parliamentary Budget Officer Yves Giroux waits to appear before the Commons Finance committee on Parliament Hill in Ottawa, Tuesday March 10, 2020. THE CANADIAN PRESS/Adrian Wyld

The just released report estimates that the double hit of low oil prices and the Liberal spending to cushion the economic effects of emergency health orders closing businesses, travel, and other measures, will skyrocket to an historical record deficit in 2020-21 of just over $252 billion.

Aaron Wudrick is national director of the non-profit advocacy group Canadian Taxpayers Federation, In an email to RCI he said of the new report,”The crisis isn’t over so the final tally is likely to be even higher. When things finally do start to open up, the government needs to present a realistic plan for climbing out of it – without walloping Canadians and their businesses desperately trying to recover”,

Aaron Wudrick says of the new estimated deficit, “”It’s alarming, especially considering they estimate has more than doubled in just one month March 27, PBO estimated it would be $112 billion” (brian Morris- CBC-2018)

The PBO report says real Gross Domestic Product (GDP) will shrink 2.5 per cent in the first quarter, 20 per cent in the second but shoud rebound in the latter part of the year. Still, Budget Officer Yves Giroux estimates a GDP contraction of 12 per cent for the year that began April 1, “which would be by far the weakest on record since the series started in 1961”.

Giroux notes that additional fiscal spending to support the economy may be necessary in the coming months.

Adding an equivocal note that once the economy begins to recover and the emergency spending expires, the debt to GDP ratio should stabilize, but that if some of these current emergency measures are extented or made permanent, the debt ratio could keep climbing.

additional information -sources

- PBO- full report-pdf

- BNNBloomberg: Bolongaro/Hagen: Apr.30/20: Biggest deficit in history bound for Canada watchdog says

- CityNews: Gul/Nassar/Walryk: Apr.30/20: Federal deficit could skyrocket to $252B in 2020-21

- Canadian Press (via North Shore Newsl); Apr.30/20:Federa deficit will likely hit $252B this year

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.