Normally the federal finance minister would provide the budget in the spring and an update sometime in the fall. The COVID crisis changed that as a massive shutdown of the economy to prevent the spread of the virus resulted in vast numbers of job losses and massive emergency funding programmes to individuals and businesses to bridge the gap until the economy could get back on track.

With billions of dollars spent, the opposition parties have for weeks been calling for the government to provide an update on the economy and spending.

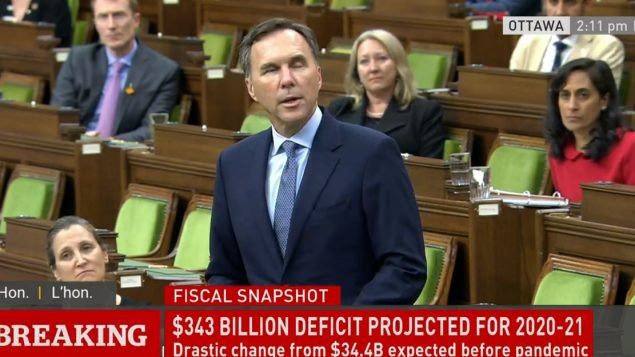

Today Finance Minister Bill Morneau delivered not a budget, but instead what is being called a fiscal “snapshot'”

While estimates of the deficit were expected to be high,due to the emergency spending related to economic fallout from the pandemic, the estimate for the fiscal year 2020-21 is now at $343.2 billion dollars.

In that figure is some $212 billion paid out directly to individuals and businesses as direct aid due to the COVID-19 situation.

The Canadian Press noted that Morneau’s snapshot used the word ‘unprecedented’ 29 times in the document.

The non-profit Canadian Taxpayers Federation advocacy group in a statement said the government did not seem to have a plan to get out of the debt noting, “The federal debt is about to hit $1,000,000,000,000, according the federal fiscal update, and Canadians should be alarmed. Unfortunately, Ottawa doesn’t seem to have a plan to manage this deep dive into debt. Pandemic-related spending has caused the deficit to balloon by more than one thousand per cent in just four months. Much of this spending was intended to temporarily address the COVID-19 crisis, but these programs are extremely expensive and unsustainable. Minister Morneau needs to lay out a plan to turn off the taps, but he failed to do that”.

As the economy slowly starts back up, questions remain as to how long these emergency programmes may be needed even as analysts suggest significantly high unemployment for the duration of the recovery period. This is also unknown as recovery could take several months to a year or longer.

An estimate of the unemployment rate at the end of this year was set at 8.8 per cent, and in 2021, still a very high 7.8 per cent.

In addition to the massive outflow of money, revenue flowing in to government coffers is also expected to decline from a projected $341 billion to $268.8 billion. Much of the revenue comes from personal income tax which will be have been greatly reduced due to high job loss. Corporate tax revenue will also decline due to COVID related shutdowns, and bankruptcies with a decline of over 22 per cent, while revenue from sales tax is estimated to decline by over 20 per cent.

Additional information-sources

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.