Fingers pointed at foreign investment, but is it justifiable?

The skyrocketing house prices in Canada, especially in two major cities, have been hot topics of discussion in Canada, and indeed in business and real estate circles around the world.

The two super-heated markets have long been Vancouver, British Columbia on the west coast, and in Toronto, Ontario in the country’s centre.

Vancouver skyline. The steep increase in condo costs is forcing many Canadians out of the housing market. Figures show foreign ownership of condos is high in Vancouver and especially the more expensive ones. PHOTO: Canadian Press

It is not unheard of for a house, in those cities to be bought and then soon after, or even almost immediately, put back on the market to be sold shortly after at a substantial profit.

The complaint is that most Canadians in those cities, can no longer afford to buy a house and are simply being priced out of home ownership.

Many people have long said the problem is because of “foreign” money and speculation.

Large house under construction in 2015 in a Vancouver neighbourhood that is popular with Chinese buyers, some of whom might be non-residents

PHOTO: REUTERS/Julie Gordon

Now Canada’s national statistics gathering agency, Statistics Canada (StatsCan) has published comprehensive data. It shows that the widely held belief that “non-residents” with offshore money are pushing up prices, is both right and wrong.

- RCI: Feb 2016: steep rise in house prices

- RCI- Jun 2016: Canadian house prices: bad for cities

- RCI-Jan 2017: you can’t afford to live here

- RCI- Apr 2017: Toronto tries to cool prices

- Maclean’s Magazine:May 2016: China buying Canada

The new StatsCan figures show a much greater percentage of foreign ownership than previously indicated in studies by the Canada Mortgage and Housing Corporation (CMHC)

By the same token, the new stats are not nearly as high as popular opinion would believe. The StatsCan data shows 4.8 per cent of all housing in metro Vancouver is foreign owned (non-resident) and 3.4 per cent in the Greater Toronto Area (GTA)

But critics say, even this is underestimated as StatsCan counts Canadian-based corporations owning property as resident owners, in spite of the ease at which a non-resident can create such a company.

Another study showed that when it came to condos in Vancouver, 19 per cent of those built in 2016-17 were owned by non-residents.

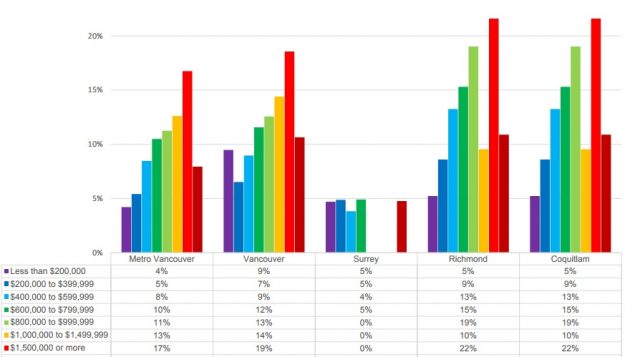

A study by Andy Yan of Simon Fraser University showed that 10% of condos worth $600,000 or more were owned by non-residents.

This rose to 19 per cent in Vancouver for condos worth $1.5 million or more, and that rose to 22 per cent in some neighbouring communities.

Non-resident ownership of condos, Vancouver: Far left-condos at $200k or less, and rising by $200k with each colour to red bar @ .$1.5 million or more.. The final dark red bar is all levels combined IMAGE-Andy Yan Community Data Science@ the SFU City Program (based on Stats Can table 035-0005

StatsCan for its part says it will likely broaden its study of the housing market in a new study to be released early this year saying this first effort is just the “tip of the iceberg”.

The polling firm Angus Reid has conducted research on perceptions of foreign ownership of housing (houses/condos) and in both 2016, and 2017, found that Canadians firmly and clearly believe foreign money is behind the skyrocketing housing prices.

They asked Vancouver residents in 2015 and a year later in 2016 about their thoughts related to foreign ownership and rising costs and in both cases, it was firmly believed that the excessive and increasing prices were due to offshore money.

Vancouve established a non-resident tax on housing sales which slowed prices for a while, but they’ve began to rise again.

Vancouver’s lead of a 15 per cent non resident transfer tax has just been instituted in Ontario as of Dec. 16, 2017, and will be applied not just to the superhot Toronto market, but to the much wider Greater Toronto and Hamiltaon Area (GTHA) and beyond.

For reasons beyond our control, and for an undetermined period of time, our comment section is now closed. However, our social networks remain open to your contributions.